Company: Quintana Energy Services Inc.

Symbol: QES

Description: They are a growth-oriented provider of diversified oilfield services to leading onshore oil and natural gas exploration and production (E&P) companies operating in both conventional and unconventional plays in all of the active major basins throughout the U.S. The following business segments comprise our primary services: (1) directional drilling services, (2) pressure pumping services, (3) pressure control services and (4) wireline services.

Shares: 9.3 million

Price Range: $12.00-$15.00

Trade Date: 2/8

Underwriter(s): BofA Merrill Lynch, Simmons & Company International

Co-Manager(s): Citigroup, Barclays, Tudor Pickering Holt & Co., Evercore ISI, Stephens Inc., Capital One Securities

Terms Added 1-29-18

Business: The following business segments comprise their primary services: (1) directional drilling services, (2) pressure pumping services, (3) pressure control services and (4) wireline services. They currently operate throughout all active major onshore oil and gas basins in the U.S. and they served more than 800 customers as of November 30, 2017.

Financials:

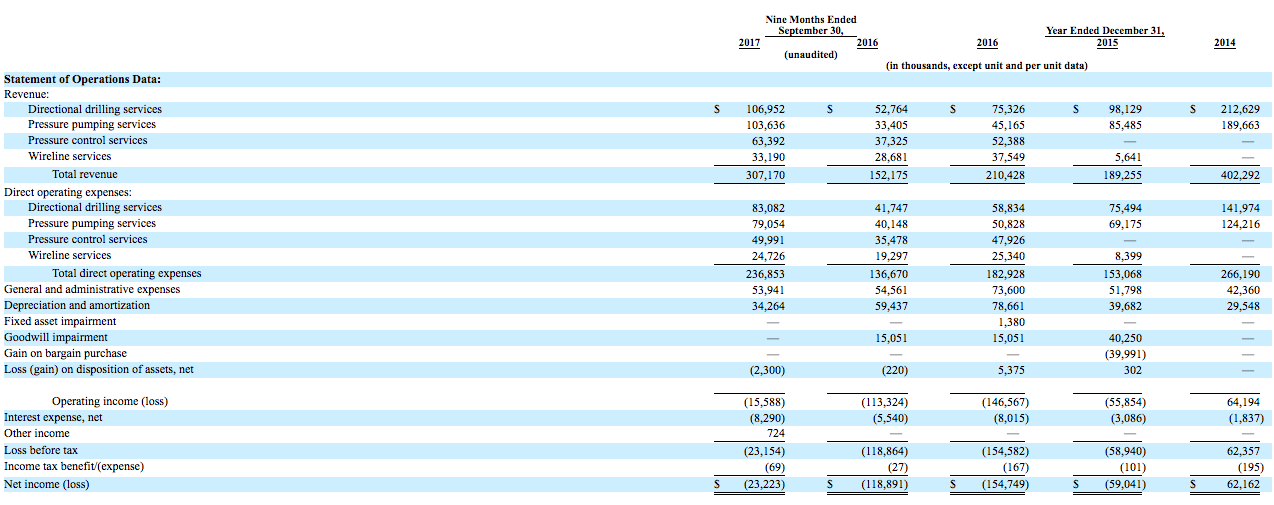

Their total revenue was $402.3 million, $189.3 million and $210.4 million and their net income (loss) was $62.2 million, ($59.0 million), and ($154.7 million) in 2014, 2015, and 2016, respectively. In the first three quarters of 2016 and 2017, their total revenue was $152.2 million and $307.2 million and their net loss was $23.2 million and $118.9 million, respectively.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.