Late July into early August turned out to be a rough and tough tape for the IPO market. Deals that were multiple and/or well-oversubscribed saw its demand evaporate as soon as its respective ticker went ‘into the box.’

Amplify Snack Brands (NYSE: BETR) opened $1.00 below its offering price after pricing $2.00 above the range–an absurdity in the IPO market. Planet Fitness (NYSE: PLNT) upsized and priced at the high-end of the range only to meet an instant 9.3% decline in the stock at first trade.

“There was a substantial amount of ‘fluff’ orders,” senior managing partner at IPO Boutique, Scott Sweet, said. “This was ascertained post-IPO which skewed the true read of ‘channel-checks’. As soon as any IPO breaks the offering price there are many who immediately flip the deal to minimize the loss on the transaction.”

While scouring the internet, we came across a well-written article by someone who is a frequent ‘tweeter’ about the IPO market — @JFinDallas –. He believes that if “big institutional investors sidestep IPOs you are left with traders, funds or investors that are only in the order book with the intention of flipping their shares and generally weaker hands”.

The article continues to warn investors the dangers of trading broken IPOs. There are plenty of cases where IPOs that trade under their IPO price have a hard time of creating momentum. See the trouble that Castlight Health, WayFair and DAVIDsTea have had in the last two years. While Wayfair dug itself out of a hole, it took a long time to get there.

Circling back to ‘BETR’ and ‘PLNT’…the latter has traded better since its IPO debut day. CNBC’s Bob Pisani makes note of the ‘millenial trend’ of the IPO market. How this translates to the weak openings of these two deals…I’m not exactly sure as the financials were strong in both Amplify Snack Brands and Planet Fitness. The only idea would be a fundamental difference of opinion that ‘millenials’ are very-much transient and the idea they will have little to no loyalty to a product–aka loyalty to the rapid, continued sales growth of ‘Skinny Pop’ –Amplify Snack Brand’s top selling product.

Some would call the lack of follow thru demand in IPOs that debut as a sign of exhaustion in the new issue’s market. I’m sure there is ‘some truth’ to that statement…but instantly (and yes, it happens every year) there is the group of people that believe this is the death-sign of a dreaded correction.

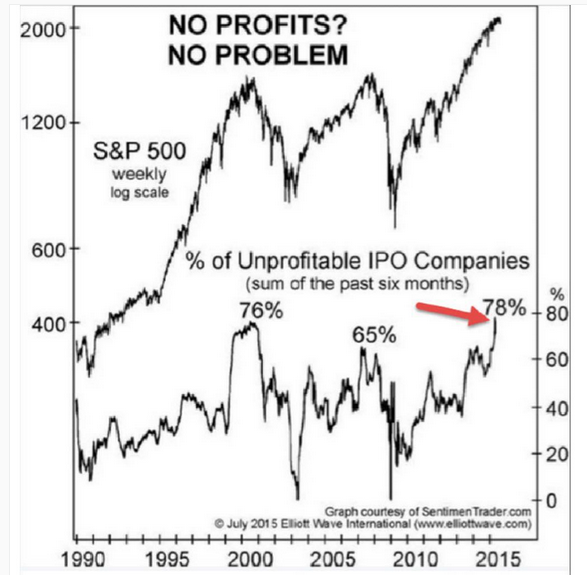

This time around, we have seen a picture circulating ‘StockTwits’ depicting stock market correlation with the number of unprofitable IPOs coming to market.

This paints a picture that a doom and gloom market of 2001 or 2008 is right around the corner. However, the two ‘broken’ IPOs from the week of August 3rd, we should point out, were both profitable. Furthermore, the number of IPOs coming to market over the next month will indeed be few and far between but not because of a ‘broken down’ IPO market. The latter half of the month of August until after Labor Day is the ‘typical’ slow time of year for IPOs.