Company: Pluralsight, Inc.

Symbol: PS

Description: Pluralsight is an enterprise software company committed to closing the global technology skills gap.

Trade Date: 5/17

Shares: 20.7 million

Price Range: $10.00-$12.00

Underwriter(s): Morgan Stanley, J.P. Morgan, Barclays, BofA Merrill Lynch

Co-Manager(s): First Analysis Securities, Needham & Co., Raymond James, SunTrust Robinson Humphrey

Terms Added: 5-7-18

UPDATE: New Prospectus Increasing Range to $12-$14

Business: Pluralsight is an enterprise software company committed to closing the global technology skills gap. This gap is holding back companies and entire industries from reaching their full potential.

The skills gap exists because technology is changing faster than the world’s ability to acquire and adapt to new skills. To address this challenge, many companies still use traditional in-person, instructor-led training, or ILT, models, which don’t move fast enough or scale quickly enough to meet the ever-increasing demand.

They disrupt these in-person ILT models by offering a cloud-based technology learning platform that is broadly accessible. Learners on their platform can quickly acquire today’s most valuable technology skills through high-quality learning experiences delivered by subject-matter experts, available on any device at any time. They provide businesses with visibility into the strengths of their workforce, allowing them to better align resources, provide targeted skill development, and advance the skills of their teams.

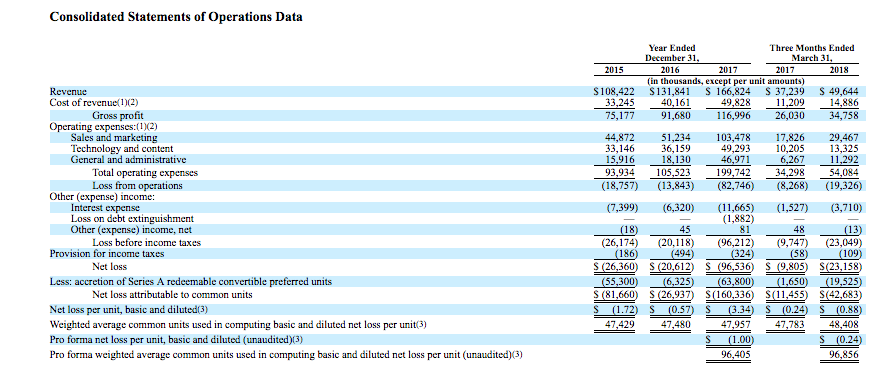

Financials: They have achieved significant growth in recent periods. For the years ended December 31, 2016 and 2017, their billings were $149.2 million and $205.8 million, respectively, representing year-over-year growth of 38%, and their billings from business customers were $104.9 million and $163.0 million, respectively, representing year-over-year growth of 55%. For the three months ended March 31, 2017 and 2018, their billings were $38.9 million and $55.4 million, respectively, representing period-over-period growth of 43%, and their billings from business customers were $29.3 million and $45.3 million, respectively, representing period-over-period growth of 54%. For the years ended December 31, 2016 and 2017, and the three months ended March 31, 2017 and 2018, their revenue was $131.8 million, $166.8 million, $37.2 million, and $49.6 million, respectively. Their net loss was $20.6 million, $96.5 million, $9.8 million, and $23.2 million, respectively, which reflects their substantial investments in the future growth of their business.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.