Company: PlayAGS, Inc.

Symbol: AGS

Description: They are a leading designer and supplier of electronic gaming machines and other products and services for the gaming industry.

Shares: 10.25 million

Price Range: $16.00-$18.00

Trade Date: 1/26

Underwriter(s): Credit Suisse, Deutsche Bank Securities

Jefferies, Macquarie Capital, BofA Merrill Lynch, Citigroup, Nomura, Stifel, SunTrust Robinson Humphrey

Co-Manager(s): Roth Capital Partners, Union Gaming, The Williams Capital Group, Apollo Global Securities

Terms Added: 1-16-18

Business: Founded in 2005, they historically focused on supplying EGMs, including slot machines, video bingo machines, and other electronic gaming devices, to the Native American gaming market, where they maintain an approximately 20% market share of all Class II EGMs. Since 2014, they have expanded their product line-up to include: (i) Class III EGMs for commercial and Native American casinos, (ii) table game products and (iii) interactive products, all of which they believe provide them with growth opportunities as they expand in markets where they currently have limited or no presence.

Sponsor Backed: In December 2013, they were acquired by the Apollo Group. Founded in 1990, Apollo is a leading global alternative investment manager with offices in New York, Los Angeles, Houston, Bethesda, Chicago, St. Louis, Toronto, London, Frankfurt, Madrid, Luxembourg, Mumbai, Delhi, Singapore, Hong Kong and Shanghai. Apollo had assets under management of approximately $242 billion as of September 30, 2017 in its affiliated private equity, credit and real estate funds invested across a core group of nine industries where Apollo has considerable knowledge and resources.

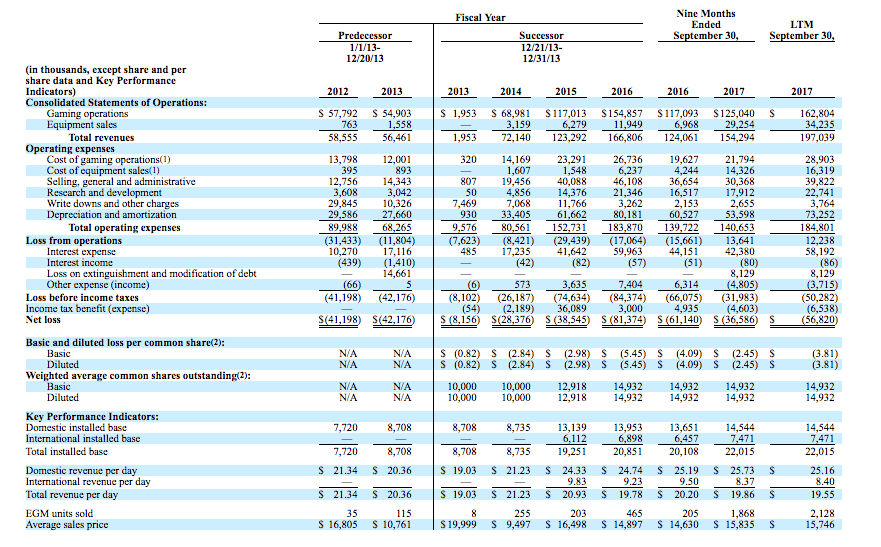

Financials: Their expansion into Class III and ancillary product offerings has driven their strong growth and momentum in revenue, EGM adjusted EBITDA and our installed base, which have increased by 173%, 158% and 152%, respectively, since 2014.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.