Company: PetIQ, Inc.

Symbol: PETQ

Description: They are a rapidly growing distributor and manufacturer of veterinarian-grade pet prescription (“Rx”) medications, over-the-counter (“OTC”) flea and tick preventatives and health and wellness products for dogs and cats.

Shares: 5.67 million

Price Range: $14.00-$16.00

Trade Date: 7/21

Underwriter(s): Jefferies, William Blair

Co-Manager: Oppenheimer & Co., Raymond James, SunTrust Robinson Humphrey

Investor Access: This deal can be accessed via the two main underwriters and the three co-managers.

Business: They pioneered and are the leading seller to the retail channel of pet products that were previously available for purchase primarily from veterinary clinics. Pet owners are increasingly migrating their purchases away from veterinarians’ offices to the channels they serve. In addition, pet owners are shifting their retail purchases from non-veterinarian-grade products, previously the only products available in the retail channel, to the premium veterinarian-grade products that they sell.

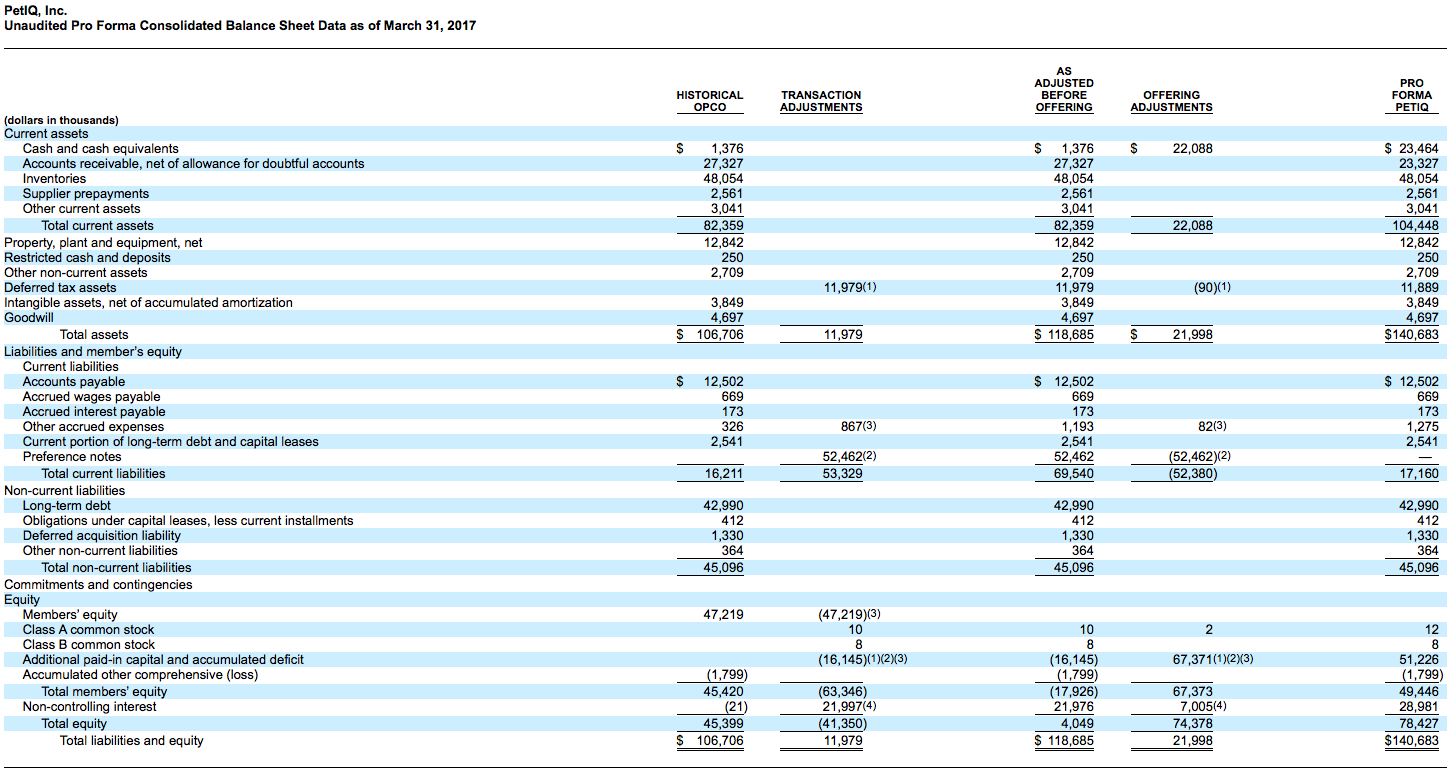

Financials:

Net sales grew from $31.8 million in fiscal year 2011 to $214.9 million for the last twelve months (“LTM”) ended March 31, 2017, representing a CAGR of approximately 44%. Net income improved from a loss of $11.0 million in fiscal year 2014 to income of $1.2 million for the LTM ended March 31, 2017. Adjusted EBITDA grew from $(5.4) million in fiscal year 2014 to $12.6 million for the LTM ended March 31, 2017 Net sales grew from $52.3 million for the three months ended March 31, 2016 to $67.0 million for the three months ended March 31, 2017, representing a 28.2% growth year over year increase. Net income grew from a loss of $(0.3) million for the three months ended March 31, 2016 to $4.3 million for the three months ended March 31, 2017. Adjusted EBITDA grew from $3.8 million for the three months ended March 31, 2016 to $5.7 million for the three months ended March 31, 2017, representing a 51.0% year over year growth. The Company realized $16.6 million in net sales to Walmart as part of a one-time sales opportunity in 2015. These sales to Walmart did not recur in 2016. On a pro forma basis, excluding the one-time sales opportunity to Walmart, net sales grew approximately $11.0 million or 5.8% in 2016 as compared to 2015.

Target Audience: Their network of customers includes Walmart, Sam’s Club, Costco, PetSmart, Petco, Kroger, Target, and BJ’s Wholesale Club, among others, and more than 40,000 retail pharmacy locations. As of March 31, 2017, they served approximately 44 retail customers and more than 21,000 customer locations, located primarily in the United States and Canada. In the United States, an estimated 79% of dog owners and 77% of cat owners view their pets as family members. Pets have become a financial priority. Consumers are exhibiting greater interest in improved health for their pets and, as a result, are increasing their purchases of the most effective veterinarian-grade pet products and supplies. Pets are living longer and, as a result, have increasing medication needs. The percentage of households owning dogs aged six and older rose from 42% in 1991 to 48% in 2011, with comparable figures rising from 29% to 50% for cats. Americans spent $81.4 billion on pet products and services in 2016, nearly triple their 2001 spending of $28.5 billion. U.S. sales of pet medications for dogs and cats have grown from $5.8 billion in 2011 to an estimated $7.4 billion in 2016 and are estimated to reach $8.9 billion by 2019, representing a CAGR of 6% between 2016 and 2019. The U.S. dog and cat treat market has grown to an estimated $6.1 billion in 2016 and is estimated to reach $7.3 billion of retail sales by 2019, representing a CAGR of 6% between 2016 and 2019.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.