SUBSCRIBE TO IPOBoutique’s Free Weekly Newsletter

The first IPO blow-up of 2017 is in the books.

ObsEva Inc. (Nasdaq: OBSV) priced 6.45 million shares at the mid-point of the $14- $16 range through three underwriters: Credit Suisse, Jefferies and Leerink Partners.

ObsEva raised $96.75m in the IPO process and even rang the bell at the Nasdaq on Thursday morning.

The party ended there.

$OBSV opened 11.4% below the offering price and immediately traded lower. The underwriters appeared to try to hold the deal at the $12.00 mark but that level could not even be contained. As of 2:30, the failed IPO hit as low as $10.63 or 29.1% below the $15.00 offering price. ObsEva closed its first day with a final trade of $11.65.

Failures like this brought back nightmares of 2016’s large IPO, ZTO Express (NYSE: ZTO), who up-sized and priced above its range, only to open $1.00 lower and trade miserably (and still does to this day) in the aftermarket. The difference between $ZTO and $OBSV is that ObsEva “should” not hurt investors as much because the size of $OBSV likely means small allocations (relatively speaking) compared to the shares being allocated for $ZTO.

But the truth is, if you get stung…it still hurts.

There are two questions — could this have been avoided and how to proceed moving forward.

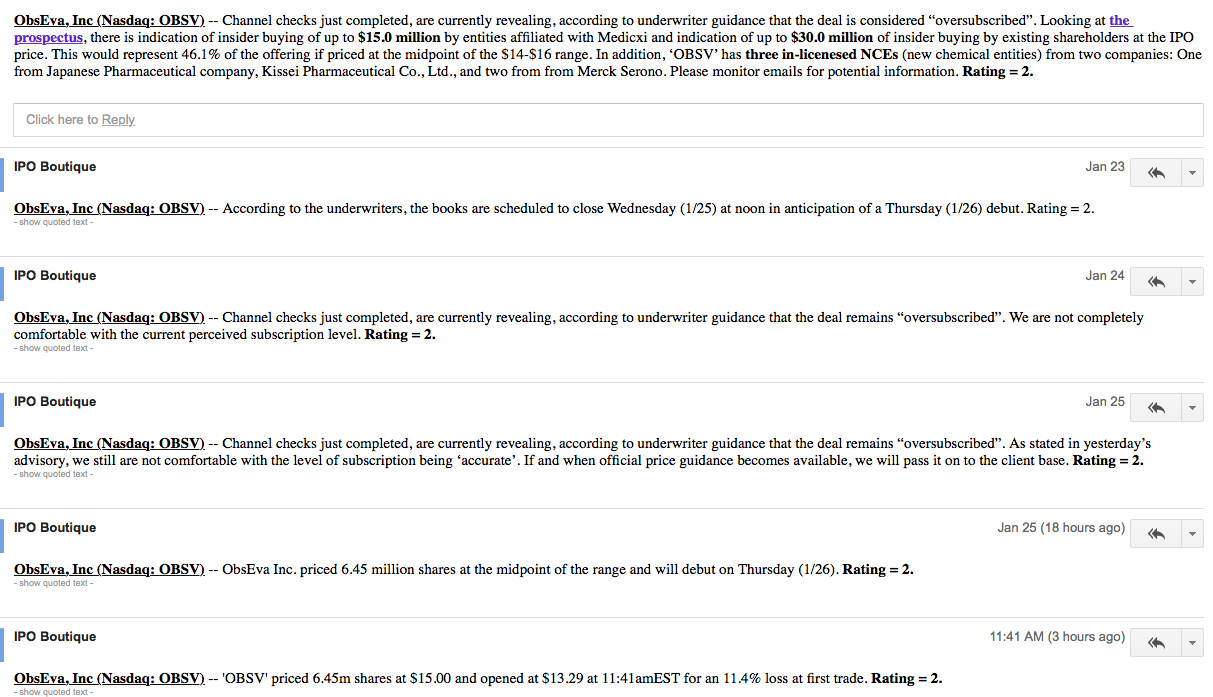

IPO Boutique is a pre-IPO research, advisory and ratings service. We judge our success based upon a first-trade/first-week basis. In the case of ObsEva, let’s look at this week’s messages that were sent to subscribers.

And as a note, IPO Boutique generally rates new issues either a 2, 3, or 4. (click to enlarge)

The subscription level being publicly touted was not adding up with our sources. This was a warning sign sent to the subscriber-base days in advance. Using our information, most of our clients knew to steer clear of $OBSV. For those that still elected to play, they may have done this with much smaller size. To answer the question: could this have been avoided — that answers is ‘YES’.

Now secondly, how to proceed. The healthcare sector in general is considered highly volatile. There have been massive IPO gains on healthcare stocks as well as massive losses. We chronicled the nature of these IPOs in our newsletter this past Sunday and that article was posted on our blog on Tuesday. The takeaway quote in the article is:

“But investors may have to do triage: figure out what they’re going to spend money on and what they’re not going to fund.”

When something is out of favor and is not priced favorably, we see action like $OBSV. IPOs can provide massive gains but gain provide large losses in a very short amount of time. It’s what makes this trading vehicle so enticing.

So, why guess when it comes time to indicating for IPOs? Let IPO Boutique provide the research, ratings and daily advisories using our global & syndicate sources. Indicate with confidence.

The good news? The year is young and there are plenty more IPOs that can hopefully clean up the mess that ObsEva left behind in its debut.