Company: Nine Energy Service, Inc.

Symbol: NINE

Shares: 7 million

Price: $20.00-$23.00

Description: They are a leading North American onshore completion and production services provider that targets unconventional oil and gas resource development. They partner with their exploration and production customers across all major onshore basins in both the U.S. and Canada to design and deploy downhole solutions and technology to prepare horizontal, multistage wells for production.

Trade Date: 1/19

Underwriter(s): J.P. Morgan, Goldman Sachs & Co., Wells Fargo, BofA Merrill Lynch, Credit Suisse

Co-Manager(s): Raymond James, Simmons & Company International, Tudor Pickering Holt & Co., HSBC, Scotia Howard Weil, UBS Investment Bank

Business: They partner with their E&P customers across all major onshore basins in both the U.S. and Canada to design and deploy downhole solutions and technology to prepare horizontal, multistage wells for production. They focus on providing their customers with cost-effective and comprehensive completion solutions designed to maximize their production levels and operating efficiencies. They believe their success is a product of their culture, which is driven by their intense focus on performance and wellsite execution as well as their commitment to forward-leaning technologies that aid them in the development of smarter, customized applications that drive efficiencies.

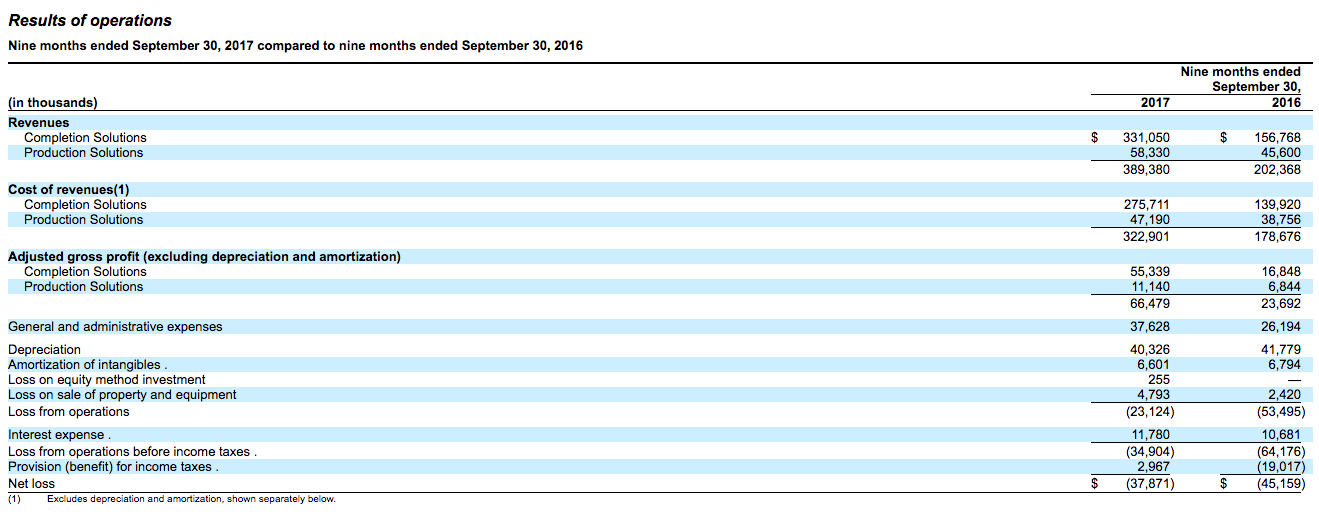

Financials: Their revenues were $633.2 million, $478.5 million and $282.4 million and their net income (loss) was $48.0 million, ($39.1 million) and ($70.9 million) in 2014, 2015, and 2016, respectively. In the first three quarters of 2017, their revenues increased 92.4% to $389.4 million, while their net loss decreased 16.1% to $37.9 million, compared to the same period in the previous year.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.