Company: Mersana Therapeutics, Inc.

Symbol: MRSN

Description They are a clinical stage biopharmaceutical company focused on developing antibody drug conjugates, or ADCs, that offer a clinically meaningful benefit for cancer patients with significant unmet need.

Shares: 5 million

Price Range: $14.00-$16.00

Trade Date: 6/28

Underwriter(s): J.P. Morgan, Cowen and Company, Leerink Partners

Co-Manager: Wedbush PacGrow

Investor Access: This deal can be accessed via the three main underwriters and the co-manager.

Business:

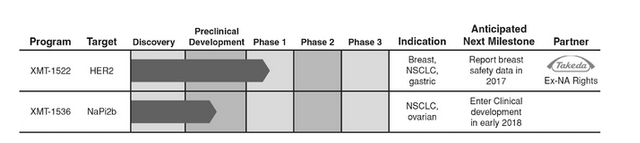

They have leveraged 20 years of industry learning in the ADC field to develop proprietary technologies that enable them to design ADCs to have improved efficacy, safety and tolerability relative to existing ADC therapies. Their most advanced platform, Dolaflexin, has been used to generate a pipeline of proprietary ADC product candidates to address patient populations that are not currently amenable to treatment with traditional ADC-based therapies. Their lead product candidate, XMT-1522, is a HER2-targeted ADC currently in a Phase 1 dose escalation study in primarily breast cancer patients, with interim safety results expected by the end of 2017. Upon the completion of dose escalation, they plan to expand clinical development of XMT-1522 into additional breast cancer, non-small cell lung cancer, or NSCLC, and gastric cancer patient populations, all of which are not addressed by existing HER2 therapies. Their second product candidate, XMT-1536, is an ADC targeting NaPi2b, an antigen broadly expressed in ovarian cancer and NSCLC. They expect XMT-1536 to enter clinical development in early 2018.

Beyond their two lead product candidates, they continue to invest in their earlier stage product candidates and in their ADC technologies. ADCs are an established therapeutic approach in oncology used to selectively deliver a highly potent chemotherapeutic payload directly to tumors thereby minimizing toxicity to surrounding healthy tissue. Upon binding to the tumor cell antigen, the ADC is internalized by the tumor cell and the payload is released, killing the cell in a targeted manner. Currently, there are two approved and broadly available ADCs which achieved combined worldwide net sales in excess of $1 billion in 2016. There are also approximately 60 ADCs presently in development in over 300 clinical studies, the vast majority of which are focused on the treatment of cancer. They believe the commercial success of previously approved ADCs, combined with the number of ADCs currently in clinical development, demonstrates the potential of ADCs to become a mainstay of cancer treatment.

Collaboration:

This company has a collaboration with Takeda — this according to the prospectus:

“In January 2016, they entered into a collaboration agreement with Takeda for the development and commercialization of XMT-1522. Under this agreement, Takeda obtained exclusive rights to XMT-1522 outside of the United States and Canada. To date, they have received upfront and milestone payments totaling $46.5 million, and may receive future development, regulatory and commercial milestones as well as tiered royalties on net sales of XMT-1522 in Takeda’s territory.

In March 2014, they entered into a collaboration agreement with Takeda for the development and commercialization of ADC product candidates utilizing Fleximer. In January 2016, they amended this agreement to expand the partnership and received an additional $13.5 million. Under this agreement, Takeda may select up to seven target antigens for which they are responsible for generating antibodies for them to conjugate with Fleximer and their proprietary payloads to create the ADC product candidates. Takeda has the exclusive rights to, and is responsible for, the further development, manufacture and commercialization of these ADC product candidates. Under certain circumstances, they have the option to co-develop and co-commercialize one of these products in the United States”

Comp / Sector Performance: Eight of ten Healthcare IPOs have priced in-range so far in 2017 with two pricing above the range. The average gain at first trade for the Healthcare sector in 2017 is 6.3% and those nine deals have traded higher on average. The current gain for the Healthcare sector of the IPO market above its offering price is 18.7%.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.