The long-awaited Lyft Inc (LYFT) IPO is officially in the queue. The company now waits the mandated time period before they are allowed to set terms (shares offered, price range) and place a valuation on their company.

While we wait for that date and potential late March debut…let’s look at five things we are focusing on from Friday’s filing.

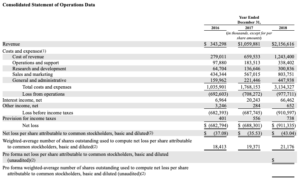

1. Lyft Revenue Growth – This is the bread and butter of what IPO investors look at prior to investing in the IPO. Lyft had revenues from 2016-to-2018 of $343.3, $1.059bn and $2.157bn, respectively. The latest year’s numbers represent a 103.6% growth. Net loss in that same period was $682.7m, $688.3m and $911.3m. The widening losses and sheer magnitude of losses may be enough to scare some investors. However, the 103.6% revenue growth is something investors are willing to “pay-up” for…provided the valuation (which is not yet known) is not absurd.

2. Lyft’s Ride Sharing Metrics – Lyft will be the first major ride-sharing company to hit the public markets and with that come new metrics. The one that ‘stands-out’ to is the Revenue-Per-Active-Rider model. The S-1 has this tracked on a three-months-ended basis beginning with the quarter ended March 31, 2016. Impressively, Lyft has been able to increase this number for a current streak of 10-consecutive quarters. The quarter ended December 2018, the Revenue-Per-Active Rider was $36.04 compared to $33.65 from the previous quarter and $12.60 from the quarter ended December 31, 2017.

3. Lyft’s Ownership Power- Who’s getting rich from the Lyft IPO? Well, the co-founders, Logan Green and John Zimmer each own 1.18mm shares in the company. But the largest stake is Sean Aggarwal’s 1.406mm share stake. He was an early angel investor in the company and sits on the board. One talking point that is “sure-to-come-up” in the upcoming roadshow will be the share structure. There will be two classes of shares with the executive team’s shares holding 20x the voting power as the Class A shares which will be offered to new investors. This type of voting structure is heavily weighted to a point where insiders remain in practically complete control. A heavily-weighted voting structure was part of the Snap Inc (SNAP) IPO and was eventually digested but met with some resistance.

4. Lyft’s Backers –But the real “interesting” nugget we focus on is corporate or VC (venture capitalist) ownership. The largest corporate stake is Rakuten Europe — a Japanese e-commerce company — with a 13% position. General Motors, Fidelity and Alphabet own 7.76%, 7.71% and 5.33%, respectively. The lone VC listed on the prospectus is Andreesen Horowitz with a 6.25% ownership stake.

5. Lyft Focus Moving Forward – The ride-sharing category has two major players: Lyft and Uber. An IPO for both of these companies is what both companies hope to be an early chapter in a long-novel. But to have staying power, the company must be forward thinking and Lyft’s filing gives us a first hand look at one strategy to maintain sustainability: Autonomous Vehicle Strategy.

Pioneering Autonomous Vehicle Strategy.We are investing in autonomous technology and employ a two-prongedstrategy to bring autonomous vehicles to market. Our Open Platform provides market-leading developers of autonomous vehicle technology access to our network to enable their vehicles to fulfill rides on our platform. Simultaneously, we are building our own world-class autonomous vehicle system at our Level 5 Engineering Center, with the goal of ensuring access to affordable and reliable autonomous technology. We believe that the strength of our brand, our trusted relationships with riders and our expertise in operating a ridesharing network at scale, as well as our two-pronged strategy to bring autonomous vehicles to market, will be competitive advantages that will enable us to capture value in the emerging autonomous vehicle ecosystem.