Company: Kala Pharmaceuticals, Inc.

Symbol: KALA

Description: They are a biopharmaceutical company focused on the development and commercialization of therapeutics using their proprietary nanoparticle-based Mucus Penetrating Particles, or MPP, technology, with an initial focus on the treatment of eye diseases.

Shares: 6 million

Price Range: $14.00-$16.00

Trade Date: 7/20

Underwriter(s): J.P. Morgan, BofA Merrill Lynch, Wells Fargo Securities

Co-Manager: Wedbush PacGrow

Investor Access: This deal can be accessed via the three main underwriters and the co-manager. Additionally, Motif is a selling group on the offering but has now closed orders on this deal.

Business: We are a biopharmaceutical company focused on the development and commercialization of therapeutics using our proprietary nanoparticle-based Mucus Penetrating Particles, or MPP, technology, with an initial focus on the treatment of eye diseases. Their MPPs are selectively-sized nanoparticles and have proprietary coatings. They believe that these two key attributes enable even distribution of drug particles on mucosal surfaces and significantly increase drug delivery to target tissues by enhancing mobility of drug particles through mucus and preventing drug particles from becoming trapped and eliminated by mucus.

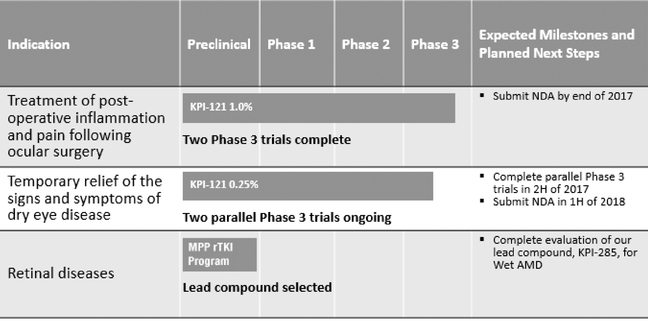

They have completed two Phase 3 clinical trials of KPI-121 1.0%, their topical twice-a-day product candidate for patients with inflammation and pain following cataract surgery. Based on the results of their two completed Phase 3 trials of KPI-121 1.0%, they anticipate submitting an NDA for the approval of KPI-121 1.0% for the treatment of post-operative inflammation and pain following ocular surgery by the end of 2017. If approved, KPI-121 1.0% could be the first FDA-approved ocular corticosteroid product for the treatment of post-operative inflammation and pain with twice daily dosing. Assuming positive results from their Phase 3 clinical trials, they anticipate submitting an NDA for KPI-121 0.25% for the temporary relief of the signs and symptoms of dry eye disease in the first half of 2018. If approved, KPI-121 0.25% could be the first FDA-approved product for the short-term treatment of dry eye disease. They

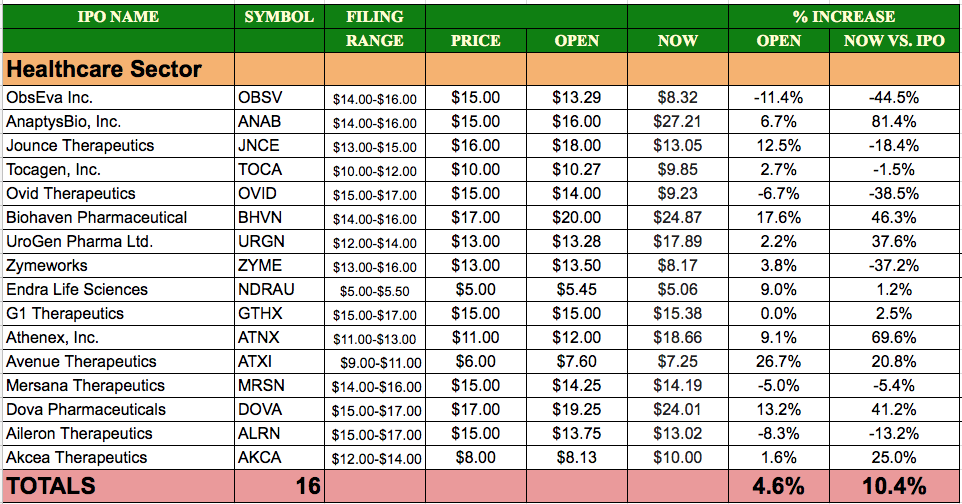

Comp / Sector Performance: The healthcare sector of the IPO market has been price sector has been up and down all year long. The deals that are in favor have performed well while four of the deals “out of favor” opened significantly below their offering price. Overall, the 16 deals have averaged a 10.4% gain above their offering price as of 3pm EST on July 18, 2017. This includes outsized gains of 81.4%, 69.6% and 46.3% by AnaptysBio, Athenex Inc and Biohaven Pharmaceuticals, respectively.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.