Company: Jianpu Technology Inc.

Symbol: JT

Shares: 22.5 million shares

Price Range: $8.50-$10.50

Description: They are the leading independent open platform for discovery and recommendation of financial products in China, whether measured by the number of loan applications or by the number of credit card applications over the period from 2012 to 2016, according to a report that we commissioned from iResearch, which we refer to as the iResearch Report.

Trade Date: 11/16

Underwriter(s): Goldman Sachs (Asia), Morgan Stanley, J.P. Morgan

Co-Manager(s): China Renaissance

Filed 11-3-17

Business: By leveraging their deep data insights and proprietary technology, theye provide users with personalized search results and recommendations that are tailored to each user’s particular financial needs and credit profile. They also enable financial service providers with sales and marketing solutions to reach and serve their target customers more effectively through online and mobile channels and enhance their competitiveness by providing them with tailored data, risk management and end-to-end solutions. They are committed to maintaining an independent open platform, which allows them to serve the needs of users and financial service providers impartially.

They have created an ecosystem that has transformed the way users discover financial products, providing them with more choices, better terms and greater convenience. China’s retail financial services market is highly fragmented, with a variety of national and regional financial institutions and emerging technology-enabled financial service providers. Their open platform, which they operate under the “Rong360” brand, has reached over 67 million registered users. In the first nine months of 2017, over 2,500 financial service providers nationwide offered more than 170,000 financial products on their platform, including consumer and other loans, credit cards and wealth management products. They collaborate with a wide variety of third-party data partners, including third-party credit information providers, payment companies and e-commerce platforms. Their thriving ecosystem of users, financial service providers and third-party data and technology partners strengthens our leadership position as a destination for financial product discovery and recommendation.

Private Placement: Concurrently with, and subject to, the completion of this offering, (i) Torch International Investment Ltd., or Torch International, an investing entity of Sailing Capital and an existing shareholder of RONG360 Inc., and its affiliates have agreed to purchase an aggregate of US$30 million in Class A ordinary shares from JT; and (ii) Article Light Limited, or Article Light, an investing entity of Yunfeng Capital and an existing shareholder of RONG360, has agreed to purchase US$10 million in Class A ordinary shares from JT. The concurrent private placements are each at a price per share equal to the initial public offering price adjusted to reflect the ADS-to-ordinary share ratio.

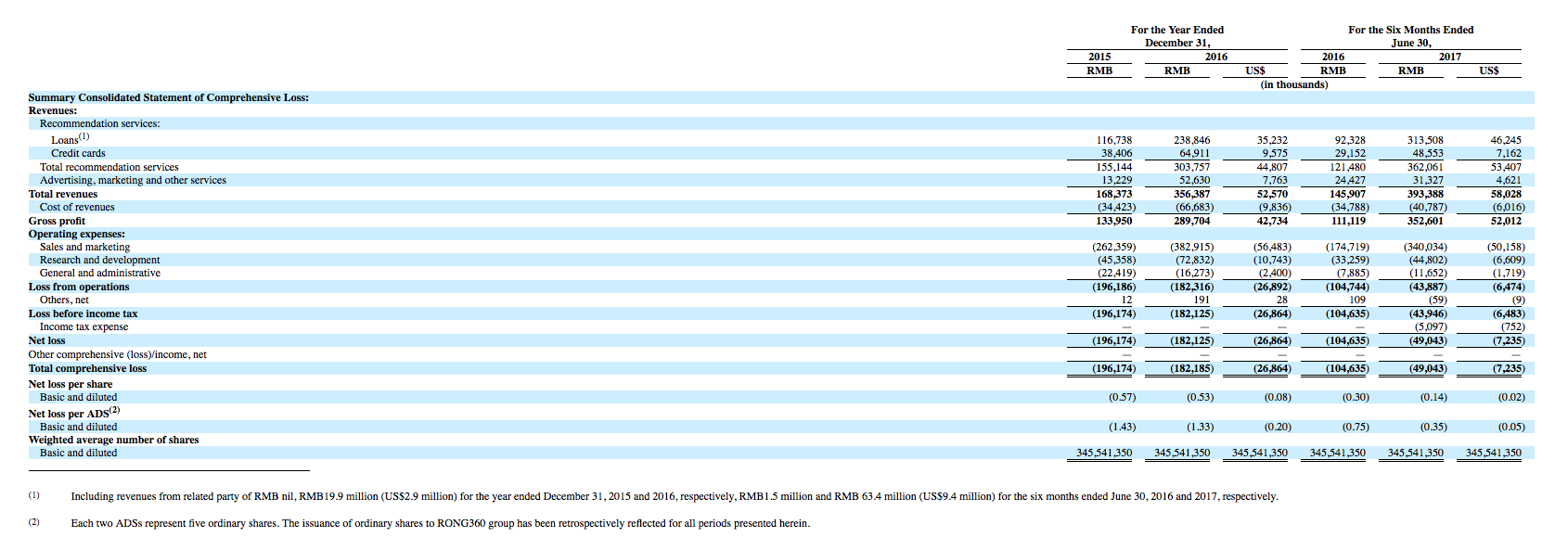

Financials: They introduced loan recommendation services in the first quarter of 2012, credit card recommendation services in the third quarter of 2013 and wealth management information services in the second quarter of 2014. They introduced their big data risk management solutions in the second quarter of 2015 and their Gold Cloud system in the first quarter of 2016. Their revenues increased by 112% from RMB 168.4 million in 2015 to RMB 356.4 million (US$52.6 million) in 2016, while their net loss decreased by 7.2% from RMB 196.2 million to RMB 182.1 million (US$26.9 million) over the same period. Their revenues increased by 170% from RMB 145.9 million in the first half of 2016 to RMB 393.4 million (US$58.0 million) in the first half of 2017, while their net loss decreased by 53.2% from RMB 104.6 million to RMB 49.0 million (US$7.2 million) over the same period.

Book-Building Status: The way the book comes together during the week of the roadshow is the bkost critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.