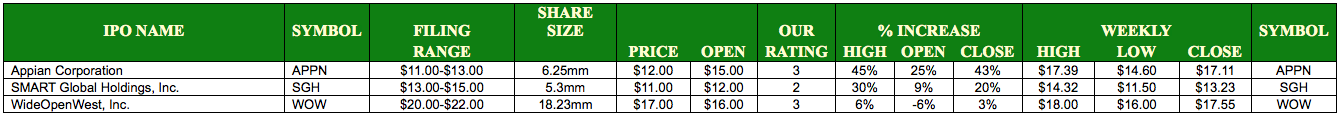

It was a week where two of the three IPOs that came to market came from the technology sector. Additionally, price sensitivity played a role as two deals priced severely below their original range. The average gain at first trade for the IPOs was 9.3%.

(click to enlarge)

Appian Corporation (NASDAQ: APPN) …a leading low-code software development platform as a service that enables organizations to rapidly develop powerful and unique applications….had one of the strongest debuts for the entire month of May. ‘APPN’ priced in the $11.00-$13.00 range at $12.00 and opened with a $3.00 premium or 25% higher. Appian Corporation rallied into the close on Friday and closed at $17.11 or 42.6% above its offering price.

SMART Global Holdings (NASDAQ: SGH), a a global leader in specialty memory solutions, serving the electronics industry for over 25 years….priced $2.00 below the $13.00-$15.00 range ($11.00) and opened at $12.00 or 9% higher.

Cable provider, WideOpenWest (NYSE: WOW), priced $3.00 below the $20.00-$22.00 range and opened $1.00 under the offering price or 5.9% lower. Within thirty minutes, however, it rebounded and traded above the offering price temporarily in its opening day before having a strong close to the week on Friday. ‘WOW’ traded as high as $18.00 and closed the week at $17.55 or 3.2% above its $17.00 offering price.