It was a trying week for the IPO market as price sensitivity and a lack of aftermarket appetite- played significant factors.

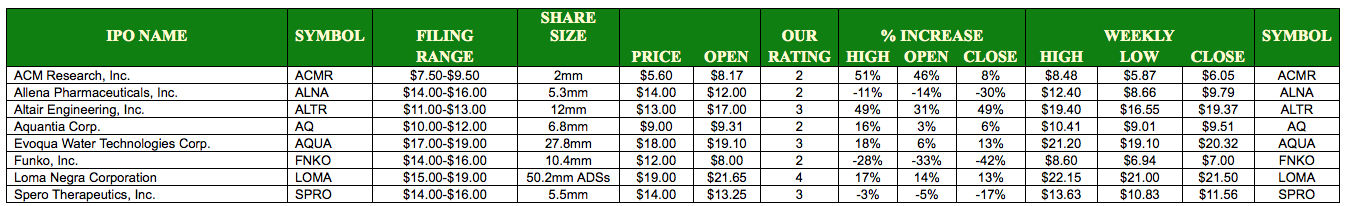

The two best deals of the week debuted on Wednesday — Altair Engineering (ALTR) and Loma Negra Corporation (LOMA). Altair Engineering priced at the top of the $11- $13 range and opened with a $4.00 premium for a gain of 30.8% at first trade. Loma Negra also priced at the high end of its range, $19.00, and opened 13.9% above the offering price with a opening tick of $21.65.

Two other offerings that debuted with success were Evoqua Water Technologies (AQUA) and Aquantia Inc (AQ) which opened with premiums of $1.10 and $0.31.

Beyond these four deals, it was a trying week. The two biotech offerings came at the low-end of their respective ranges and proceeded to open below their respective offering prices. Spero Therapeutics (SPRO) opened $0.75 below its $14.00 offering price and Allena Pharmaceuticals (ALNA) opened $2.00 below its $14.00 offering price. Neither of these deals managed to trade above their offering prices on week one.

But the headline of the week is the one we hope the client base was able to avoid — Funko, Inc (FNKO). We emphasized a pretty clear message that the deal was going ‘heavy-retail’…meaning a tell-tale sign that the IPO may be in trouble. IPOs, the majority of time, predominantly are allocated to institutions. Funko ended up downsizing its deal and priced $2.00 below range at $12.00. It was not enough to turn the pop culture toy company into a winner…by a long shot. Funko opened 33% below its offering price with an opening trade of $8.00 and closed its opening session 41% down. It should be noted that minutes before the Funko debut, Bloomberg ran a story questioning the company’s financials. The poor performance was one of the worst that we have seen on record. The closest thing we can compare this to was the MOL Global disaster of October 2014 which traded 35% lower on day one. Needless to say…book quality and the sentiment of the street was a critical component in determining this IPO was in trouble and is exhibit ‘A’ of why, we believe, our service is valuable. Not only do we want our clients to indicate for the best…but we want you to ‘avoid the rest’ as much as possible and this was a perfect example of that.

It should be noted that a deal scheduled for this past week, Energy Hunter Resources (EHR) was postponed due to market conditions.

Two IPOs came to market from lower tier underwriters and were very small cash raises, ACM Research (ACMR) and Hexindai Inc (HX), and each opened up 45.9% and 50% above their offering prices. Each deal traded closer to their offering prices within minutes of opening…showing the high volatility of these smaller deals.

Looking ahead to this week, it is another high volume week with ten new issues on the schedule — click on the logos for IPO Previews.

IPO BOUTIQUE : Syndicate…simplified.

What if you could take the guess work out of trading the syndicate calendar? Or what if you indicated for deals with the knowledge that large institutional funds are in the deal also?