Company: Altice USA, Inc.

Symbol: ATUS

Description: They are one of the largest broadband communications and video services providers in the United States.

Shares: 46.5 million

Price Range: $27.00-$31.00

Trade Date: 6/22

Underwriter(s): J.P. Morgan, Morgan Stanley, Citigroup, Goldman Sachs & Co., BofA Merrill Lynch, Barclays, BNP PARIBAS, Deutsche Bank Securities, RBC Capital Markets

Co-Manager: Scotiabank, SOCIETE GENERALE, TD Securities

Investor Access: This deal can be accessed via the nine main underwriters and the three co-managers.

Business:

Altice USA, Inc. delivers broadband, pay television, telephony services, Wi-Fi hotspot access, proprietary content and advertising services to approximately 4.9 million residential and business customers. They acquired Cequel Corporation (“Suddenlink” or “Cequel”) on December 21, 2015 and Cablevision Systems Corporation (“Optimum” or “Cablevision”) on June 21, 2016. They have made significant progress in integrating the operations of Optimum and Suddenlink and are already realizing the operational and commercial benefits of common ownership and one management team as they implement the Altice Way throughout their organization.

Since the Acquisitions, they have also upgraded their networks to nearly triple the maximum available broadband speeds they are offering to their Optimum customers and expanded their 1 Gbps broadband service to approximately 60% of their Suddenlink footprint, compared to approximately 40% prior to the Suddenlink Acquisition. In addition, they have commenced a five-year plan to build a FTTH network, which will enable them to deliver more than 10 Gbps broadband speeds across their entire Optimum footprint and part of their Suddenlink footprint. In order to further enhance the customer experience, they plan to introduce a new home communications hub during the second quarter of 2017. They are also beginning to offer managed data and communications services to their business customers and more advanced advertising services, such as targeted multi-screen advertising and data analytics, to their advertising and other business clients.

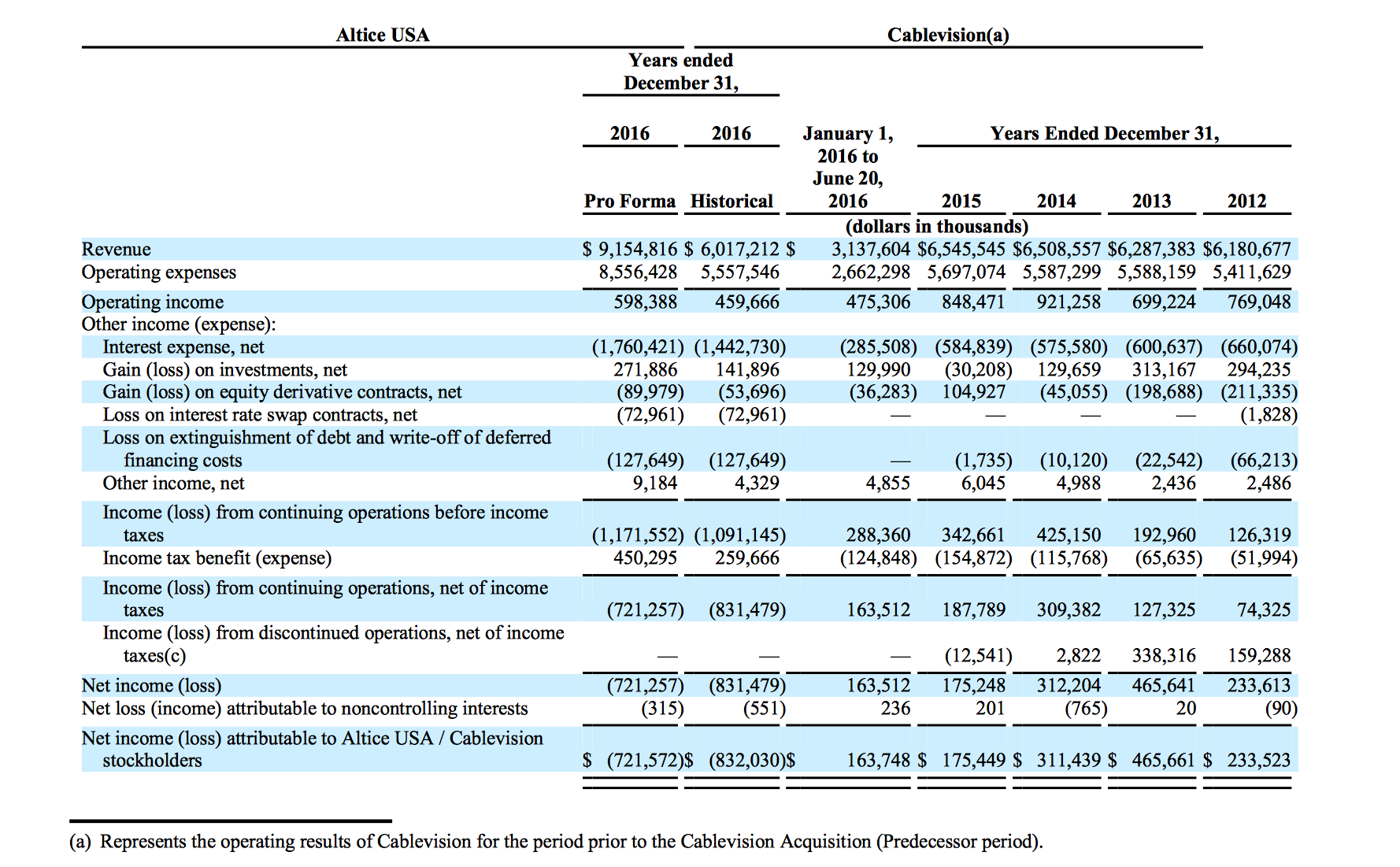

Financials:

Comp / Sector Performance: The sixth largest cable operator in the United States, WideOpenWest (NYSE: WOW) went public on May 25th to a mixed debut. ‘WOW’ opened $1.00 below the $17.00 issue price but traded higher in its opening day and week. ‘WOW’ hit a first-week high of $18.00 and is currently trading in the $17.30s. Other large cable operators, AT&T and Comcast also are competitors for Altice USA and those two companies have mixed results. AT&T is down 7% year-to-date and Comcast is up nearly 20% year-to-date.

Any cable provider will have to answer the question of competition in this digital era. There are ample OTT platforms such as Amazon, Hulu, Netflix and YouTube which could provide negative sentiment to this new issue. However, overall the U.S. residential broadband market had an estimated total size of approximately $35 billion as of May 2016, with an estimated penetration of 77% of total U.S. households as of the first quarter of 2017. They expect this growing broadband adoption and the migration of customers to higher-priced, higher-speed tiers to continue.

Demand for broadband by B2B customers is growing rapidly as well, due to secular trends such as cloud computing, e-commerce, the increasing importance of “Big Data” and the “Internet of Things”. The U.S. commercial broadband market has an estimated total size of $8 billion and is expected to grow at a compound annual growth rate (“CAGR”) of 7.3% from 2016 to 2026, faster than the projected growth rate for residential broadband Internet, which is expected to grow at a CAGR of 2.9% from 2016 to 2026.

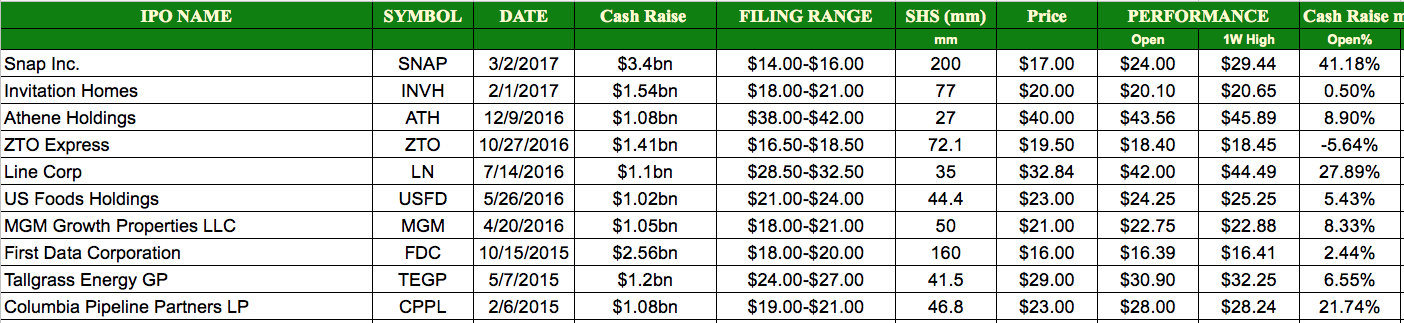

$1bn+ IPO Performance: Altice USA will be the 11th company to raise $1bn+ cash in a public offering since the start of 2015. The last to go public was Snap Inc (NYSE: SNAP) which opened more than 40% above its offering price.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.