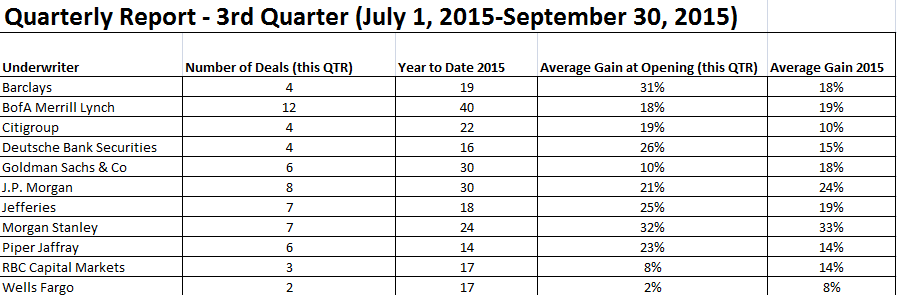

The third quarter is in the books, and it was a slow period for the IPO market with only 30 deals having debuted. You can look at how we rated each individual deal at our track record page. Below is how the statistics of how the major underwriter banks fared this quarter and year-to-date. The statistics for each underwriting bank are compiled by using IPOs where each are listed as a joint-book runner. There can be IPOs with as many as a dozen underwriters acting as book-runners. Deals where underwriters are considered ‘co-manager’s’ are not included in the statistics.

Morgan Stanley continues to lead the way in consistency for overall performance. MS was on seven deals this quarter with an average first return of 32% above the offering price. Deals that Morgan Stanley are on so far in 2015 produce an average opening trade return of 33% above the offering price–the most from the top-tier underwriters we cover. Bank of America Merrill Lynch continues to lead the way in number of deals–being on the books for 12 deals this quarter and now 40 in 2015. J.P. Morgan had another solid quarter with a 21% average return on eight deals over the past three months. Goldman Sachs showed an average 10% gain at opening for its deals but this was heavily skewed by the 73% boost that Global Blood Therapeutics (Nasdaq: GBT) had above the offering price. The under-the-radar star from the quarter is the performance of Piper Jaffray underwritten deals. Piper was on the books for six deals and produced a return of 23-percent.

For a full list of how all underwriters performed, big and small, look below.

| Quarterly Report – 3rd Quarter (July 1, 2015-September 30, 2015) | ||||

| Underwriter | Number of Deals (this QTR) | Year to Date 2015 | Average Gain at Opening (this QTR) | Average Gain 2015 |

| Aegis Capital | 0 | 2 | N/A | 0% |

| Axiom Capital Management | 0 | 1 | N/A | 0% |

| Baird | 1 | 5 | 3% | 13% |

| Barclays | 4 | 19 | 31% | 18% |

| BB&T Capital | 1 | 1 | 0% | 0% |

| BMO Capital Markets | 2 | 4 | 7% | 2% |

| BofA Merrill Lynch | 12 | 40 | 18% | 19% |

| Canaccord Genuity | 0 | 1 | N/A | 1% |

| Chardan Capital Markets | 0 | 2 | N/A | 0% |

| China Renaissance | 1 | 1 | 4% | 4% |

| Citigroup | 4 | 22 | 19% | 10% |

| Cowen and Company | 2 | 11 | 26% | 10% |

| Credit Agricole | 0 | 1 | N/A | 0% |

| Credit Suisse | 7 | 25 | -2% | 12% |

| D.A. Davidson & Co. | 0 | 1 | N/A | 9% |

| Deutsche Bank Securities | 4 | 16 | 26% | 15% |

| Evercore ISI | 1 | 4 | 0% | 8% |

| FBR | 0 | 1 | N/A | 0% |

| Goldman Sachs & Co | 6 | 30 | 10% | 18% |

| J.P. Morgan | 8 | 30 | 21% | 24% |

| Jefferies | 7 | 18 | 25% | 19% |

| Keefe Bruyette & Woods | 1 | 3 | 9% | 16% |

| Ladenburg Thalmann & Co. | 0 | 1 | N/A | 11% |

| KeyBanc Capital Markets | 0 | 1 | N/A | 40% |

| Laidlaw & Company | 0 | 1 | N/A | 6% |

| Leerink Partners | 1 | 9 | 11% | 17% |

| Macquarie Capital | 0 | 1 | N/A | 2% |

| Maxim Group | 0 | 2 | N/A | -6% |

| Morgan Stanley | 7 | 24 | 32% | 33% |

| National Securities Corporation | 1 | 1 | 30% | 30% |

| Nomura | 1 | 2 | 0% | 0% |

| Northland Capital Markets | 0 | 1 | N/A | 0% |

| Pacific Crest Securities | 0 | 1 | N/A | -4% |

| Piper Jaffray | 6 | 14 | 23% | 14% |

| Raymond James | 2 | 4 | -2% | 1% |

| RBC Capital Markets | 3 | 17 | 8% | 14% |

| Roth Capital Partners | 1 | 2 | 32% | 22% |

| Sandler O’ Neill Partners | 1 | 3 | 9% | 10% |

| Scotia Howard Weil | 1 | 1 | 0% | 0% |

| Sterne Agee | 0 | 2 | N/A | 2% |

| Stifel | 2 | 7 | -4% | 0% |

| Sun Trust Robinson Humphrey | 2 | 5 | 2% | 10% |

| The Huntington Investment Company | 1 | 1 | 0% | 0% |

| UBS Investment Group | 1 | 7 | 21% | 9% |

| ViewTrade Securities | 0 | 1 | N/A | 0% |

| Wells Fargo | 2 | 17 | 2% | 8% |

| William Blair | 0 | 2 | N/A | 26% |

| WR Hambrecht + Co. | 0 | 1 | N/A | 21% |

| Wunderlich Securities | 0 | 1 | N/A | 0% |