SUBSCRIBE TO IPOBoutique’s Free Weekly Newsletter

Keane Group (NYSE: FRAC) will be 2017’s first IPO as the well-completion oil services company is expected to price an up-sized 22.3 million shares on Thursday night. This deal will grab many of the headlines Friday but will certainly not overshadow what many IPO investors have on their mind — and that is the storm coming next week.

Eight IPOs are scheduled for next week including the first technology deal, AppDynamics (Nasdaq: APPD). But what is getting considerable attention concerning next week is the number of healthcare deals–four in all. The IPO pipeline has not lacked healthcare companies in the past three years and it seems the negative political rhetoric is not slowing down those looking to tap the public markets. Providing support to biotech deals has been insider buying, but as we have seen in the past, that does not give the ‘green-light’ for these companies as investable IPOs in its first day or week. Reuters quoted a capital markets banker about the ‘saturation’ of the healthcare IPO market as:

“I would not say the market is saturated,” said one of the bankers. “But investors may have to do triage: figure out what they’re going to spend money on and what they’re not going to fund.”

We will be looking at the viability, recent history and other concerns of the biotech IPO market in our FREE newsletter on Sunday. Sign up here.

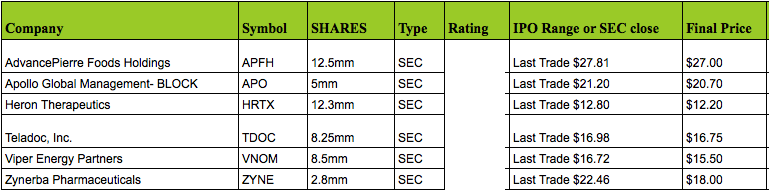

BUSY FOLLOW-ON OFFERINGS

Thursday morning was a busy day for follow-on offerings. Six deals priced prior to the opening for a total of $915.1 million. The largest deal of the six was the marketed deal by AdvancedPierre Foods Holdings (NYSE: APFH) who raised $337.5 million. Its deal was underwritten by Morgan Stanley, Credit Suisse, Barclays, BMO Capital Markets, Deutsche Bank Securities, Goldman Sachs & Co., Wells Fargo Securities and priced at a 3-percent discount, $27.00, and performed well in early trading.

IPO Boutique provides coverage of all secondary offerings to our clients. Any BUY rated secondaries are maintained in our track record all the way back to 2012.

IPO Boutique provides comprehensive research, daily advisories and ratings on EVERY IPO as well as ratings and information on all secondary offerings.

Indicate with confidence — Subscribe today.