Etsy, who operates a marketplace where people around the world connect, both online and offline, to make, sell and buy unique goods, filed for IPO on Wednesday after the close. The filing does not have terms but the filing did state they were seeking up to $100 million, which most likely is a place-holder amount until further details are released.

Etsy intends to list under the symbol ‘ETSY’ on the Nasdaq.

Here is a rundown of media coverage with $ETSY:

- Bloomberg reports IPO filing has Etsy sellers feeling angst.

- LA Times says Etsy’s growth, appeal to women highlight the IPO filing.

- ZDNet reports the Etsy filing is similar to their website: pleasant and surprising.

- Business Insider says the winner of the IPO will be Accel, who owns 30% of Etsy.

It’s somewhat of a feel-good story as Etsy becomes the first ‘tech’ company from New York City to IPO since 1999. While we cannot look at Etsy and determine if the IPO will be a buy or not due to terms not yet being released, we can dive into some of the financials:

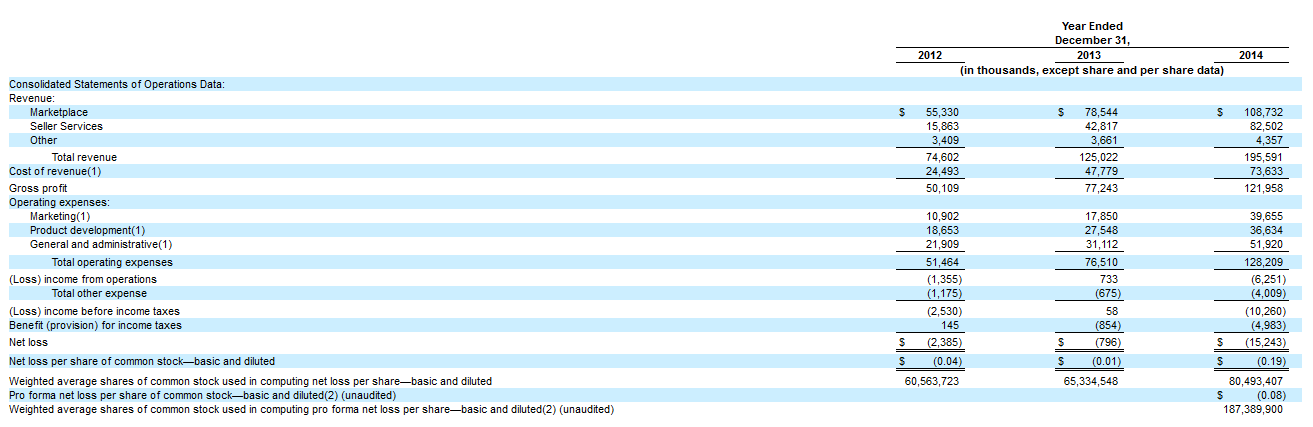

(Click to Enlarge)

The company posted revenue of $195 million for the year ended 2014 which is 56.4% above the $125 million number posted for the year ending 2013. On the downside, the net loss for Etsy went from ($796k) in 2013 to ($15.2m) in 2014 due to mainly increased marketing efforts.

“We are attracted to the Etsy IPO because of the strong top-line growth and manageable losses,” senior managing partner at IPOBoutique, Scott Sweet, said. “Their losses, especially in the last year, are due to marketing the site. This company started as a small crafts site hand-made by people, has now enabled manufacturing operations to use the site as well, therefore enhancing the company’s organic growth.”

Etsy lists Amazon (Nasdaq: AMZN), eBay (Nasdaq: EBAY) and Alibaba (NYSE: BABA) among its top competitors. The last two e-commerce IPOs, Cnova (Nasdaq: CNV) and Wayfair (NYSE:W), trade near or below their IPO price. However, many say that Etsy’s marketplace model makes it more like Alibaba. The Chinese e-commerce giant has fallen nearly 22% in the past three months and now trades below its first-day close, but is still more than 25% above the IPO price.

One portion of the S-1 could be considered ‘concerning’ to some investors as the company’s CEO, Chad Dickerson, wrote this in a letter to potential investors:

Instead of providing guidance in the traditional sense, I plan to talk frequently with our investors about our progress, challenges and opportunities. I welcome investors who share our long-term, community-oriented philosophy.

Etsy has listed Goldman Sachs & Co., Morgan Stanley and Allen & Company LLC as the lead underwriters for this IPO.