Company: Hudson Ltd.

Symbol: HUD

Description: Hudson Group, anchored by their iconic Hudson brand, is committed to enhancing the travel experience for over 300,000 travelers every day in the continental United States and Canada.

Shares: 39.4 million

Price Range: $19.00-$21.00

Trade Date: 2/2

Underwriter(s): Credit Suisse, Morgan Stanley, UBS Investment Bank, BofA Merrill Lynch, Goldman Sachs

Co-Manager(s): Banco Santander, BBVA, BNP PARIBAS, Credit Agricole CIB, HSBC, Natixis, Raiffeisen Centrobank, UniCredit Capital Markets

Terms Added: 1-19-18

Business: Their first concession opened in 1987 with five Hudson News stores in a single airport in New York City. Today they operate in airports, commuter terminals, hotels and some of the most visited landmarks and tourist destinations in the world, including the Empire State Building, Space Center Houston and United Nations Headquarters. The Company is guided by a core purpose: to be “The Traveler’s Best Friend.” They aim to achieve this purpose by serving the needs and catering to the ever-evolving preferences of travelers through their product offerings and store concepts. Through their commitment to this purpose, as part of the global Dufry Group,they have become one of the largest travel concession operators in the continental United States and Canada.

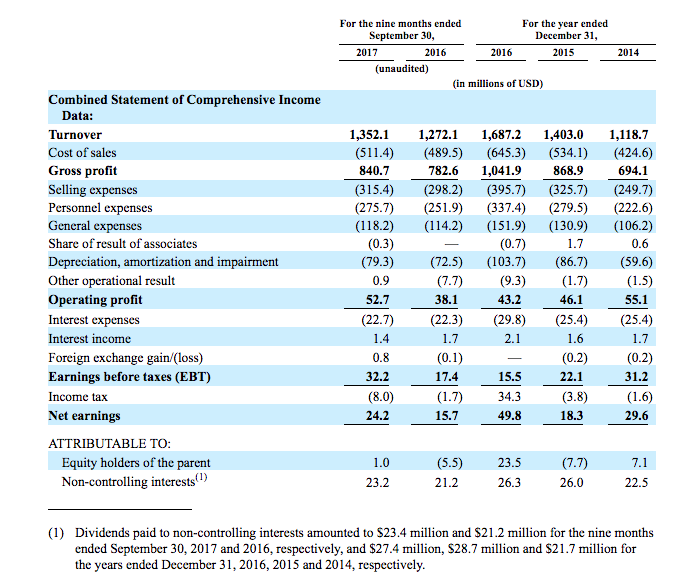

Financials: Their sales were $1.12 billion, $1.40 billion and $1.69 billion and their net earnings were $29.6 million, $18.3 million and $49.8 million in 2014, 2015, and 2016, respectively. In the first three quarters of 2017, their sales increased 6.3% to $1.35 billion, while their net earnings increased 54.1% to $24.2 million.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.