Company: Homology Medicines, Inc.

Symbol: FIXX

Description: They are a genetic medicines company dedicated to transforming the lives of patients suffering from rare genetic diseases with significant unmet medical needs by curing the underlying cause of the disease.

Trade Date: TBD

Shares: 6.67 million

Price Range: $14.00-$16.00

Underwriter(s): BofA Merrill Lynch, Cowen, Evercore ISI

Co-Manager: BTIG

Terms Added: 3-19-18

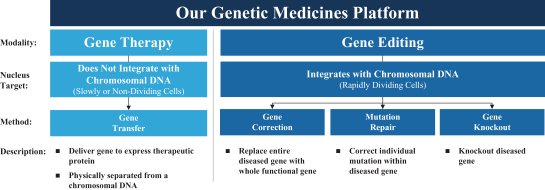

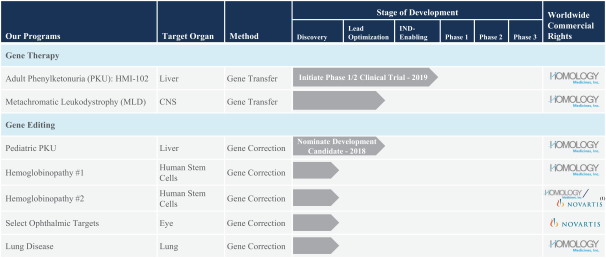

Business: Their proprietary platform is designed to utilize their human hematopoietic stem cell derived adeno-associated virus vectors, or AAVHSCs, to precisely and efficiently deliver genetic medicines in vivo either through a gene therapy or nuclease-free gene editing modality across a broad range of genetic disorders. The unique properties of their proprietary suite of 15 novel AAVHSCs enable them to focus on a method of gene editing called gene correction, either through the replacement of an entire diseased gene in the genome with a whole functional copy or the precise repair of individual mutated nucleotides, by harnessing the naturally occurring deoxyribonucleic acid, or DNA, repair process of homologous recombination, or HR.

Insider Buying: Certain of their existing stockholders, including entities affiliated with certain of our directors, have indicated an interest in purchasing an aggregate of approximately $50.0 million in shares of their common stock in this offering at the initial public offering price.

License Agreement: They currently in-license certain intellectual property from City of Hope Medical Center, or COH, and the California Institute of Technology, or Caltech, and they have entered into a collaboration and license agreement with Novartis Institutes for Biomedical Research, Inc., or Novartis.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.