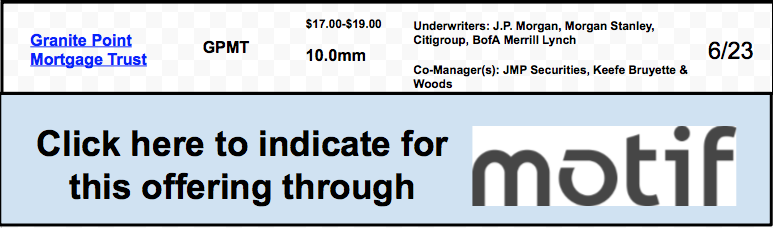

Company: Granite Point Mortgage Trust Inc.

Symbol: GPMT

Description: They are a Maryland corporation that focuses primarily on directly originating, investing in and managing senior commercial mortgage loans and other debt and debt-like commercial real estate investments.

Shares: 10 million

Price Range: $20.00-$21.00

Trade Date: 6/23

Underwriter(s): J.P. Morgan, Morgan Stanley, Citigroup, BofA Merrill Lynch

Co-Manager: JMP Securities, Keefe Bruyette & Woods

Link to S-1/A Prospectus

Investor Access: This deal can be accessed via the four main underwriters and the two co-managers or through the selling group, Motif.

Business: They were formed to continue and expand the commercial real estate lending business established by Two Harbors Investment Corp. They will be externally managed by Pine River Capital Management L.P., or PRCM, or their Manager, by the team that currently manages the commercial real estate lending business for Two Harbors. . Their primary target investments are directly originated floating-rate performing senior commercial real estate loans, typically with terms of three to five years, usually ranging in size from $25 million to $150 million. They generally target the top 25, and up to the top 50, metropolitan statistical areas in the United States, or MSAs.

Distributions:They intend to elect and qualify to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes., and intend to make quarterly distributions to their common stockholders. However, unlike some REITs, GPMT will not pay a dividend right away.

Management: Each member of their senior commercial real estate (CRE) team has over 25 years of experience in commercial real estate debt markets, and the team has worked together for over 15 years. Their senior CRE team is complemented by a group of eight professionals with broad investment management expertise and extensive industry relationships. This team has an average of over 12 years of experience in the commercial real estate debt markets, and many of its members have worked together with their senior CRE team for multiple years or most of their careers.

Comp / Sector Performance:

The U.S. commercial real estate debt market is large, with current total outstanding loan balances of more than $3 trillion as reported by the U.S. Federal Reserve Bank. Refinancing of maturing loans and acquisition activity are the principal sources of debt investment opportunities. While transaction volume tapered off modestly in 2016, sale transaction activity remains well above the troughs experienced during the depths of the crisis, and well above the levels seen over the last 15 years. Over $1.5 trillion in loans are estimated to mature over the next several years.

Traditional lenders, particularly the banks and aggregators of CMBS, are now facing a substantially changed regulatory environment and thus are more constrained in meeting borrower demand for loans. Commercial real estate fundamentals are strong driven by a continuing growth in the U.S. economy, resulting in commercial real estate property income growing and vacancies declining over the past several years. The amount of commercial real estate construction as a percentage of gross domestic product, or GDP, and associated delivery of new inventory has remained well below the 2007 peak and the 15-year historical average prior to the global economic crisis.

An increase in interest rates may cause a decrease in the availability of certain of their target investments. Rising interest rates generally reduce the demand for commercial mortgage loans due to the higher cost of borrowing. Except for customary nonrecourse carve-outs for certain “bad acts” and environmental liability, most commercial real estate loans are nonrecourse obligations of the borrower, meaning that there is no recourse against the assets of the borrower other than the underlying collateral. Their portfolio of investments is concentrated in terms of geography and asset types and may become concentrated in terms of sponsors.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.