Company: Four Springs Capital Trust

Symbol: FSPR

Description: Four Springs Capital Trust is an internally managed real estate investment trust focused on acquiring, owning and actively managing a portfolio of single-tenant, income producing retail, industrial, medical and other office properties throughout the United States that are subject to long-term net leases.

Shares: 5.6 million

Price Range: $17.00-$19.00

Trade Date: 6/23

Underwriter(s): RBC Capital Markets, SunTrust Robinson Humphrey

Co-Manager: BB&T Capital Markets, Capital One Securities, Ladenburg Thalmann, Wunderlich, Sandler O’Neill + Partners, L.P., Boenning & Scattergood, Inc.

Link to S-1/A Prospectus

Investor Access: This deal can be accessed via the two main underwriters and the five co-managers on the offering.

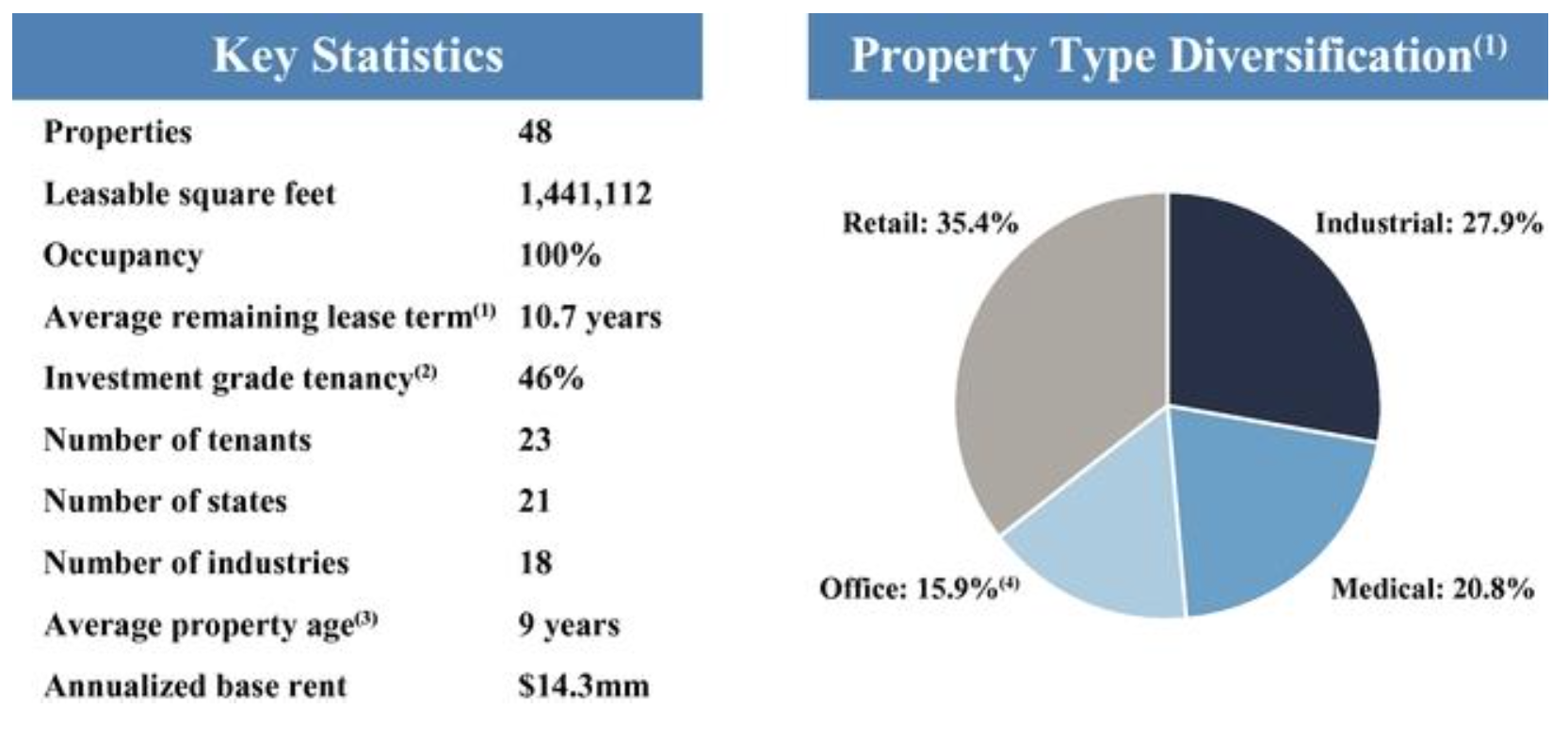

Business: Four Springs Capital seeks to acquire single-tenant net lease properties throughout the United States that are leased to high quality tenants and have remaining lease terms in excess of 10 years with contractual rent increases. As of March 31, 2017, they wholly owned, or had an ownership interest in, 48 properties located in 21 states that were 100% leased to 23 tenants operating in 18 different industries. Approximately 46% of their ABR was from leases with tenants or lease guarantors that have an investment grade credit rating from a major rating agency or have an obligation that has been so rated.

Pending Acquisitions:

On February 22, 2017, they entered into a purchase agreement to acquire a 100% ownership interest in a newly renovated, single- tenant, net lease real estate property for approximately $3.6 million. They expect to consummate this acquisition by July 31, 2017. This approximately 11,000 square foot medical office property, located in Baton Rouge, LA, is 100% occupied and leased to Ochsner Clinic Foundation for ABR of approximately $260,000 pursuant to a lease that will expire fifteen years after the commencement of the lease term upon the completion of the acquisition.

On May 19, 2017, they entered into a purchase agreement to acquire a 90% ownership interest in a newly constructed, single-tenant, net lease real estate property for approximately $21.7 million. They expect to consummate this acquisition by July 31, 2017. The approximately 61,000 square foot medical office property, located in Iowa City, IA, is 100% occupied and leased to Board of Regents, State of Iowa, for the Use and Benefit of the University of Iowa for consolidated and pro rata ABR of approximately $1.6 million and $1.4 million, respectively, pursuant to a lease that will expire in 2029.

Distributions: They intend to make a pro rata distribution with respect to the period commencing upon the completion of this offering and ending on June 30, 2017 based on a distribution rate of $0.085 per common share for a full month. On an annualized basis, this would be $1.02 per common share, or an annual distribution rate of approximately 5.7%, based on the $18.00 midpoint of the price range.

Comp / Sector Performance:

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.