Company: Four Seasons Education (Cayman) Inc.

Symbol: FEDU

Description: They are dedicated to providing high quality math education. In 2016 and the six months ended June 30, 2017, we were the largest after-school math education service provider for elementary school students in Shanghai, as measured by gross billings and number of students, according to the Frost & Sullivan Report.

Shares: 10.1 million ADSs

Price Range: $9.00-$11.00

Trade Date: 11/8

Underwriter(s): Morgan Stanley, Citigroup, China Renaissance

Business: Mathematics plays a critical role in shaping logic and reasoning, serves as a foundation for science subjects such as physics and chemistry, and has increasingly diverse applications in the new millennium. They believe high quality and effective math education can profoundly benefit students’ academic, career and life prospects. Building on their vision to unlock intellectual potential through math education, they started our business initially focusing on math education for elementary school students in Shanghai. They have experienced rapid growth, expanding from a network of 10 learning centers in Shanghai as of February 28, 2015 to 33 learning centers in five cities in China as of the date of this prospectus. They offer their programs through their variable interest entities, or VIEs, and their affiliates.

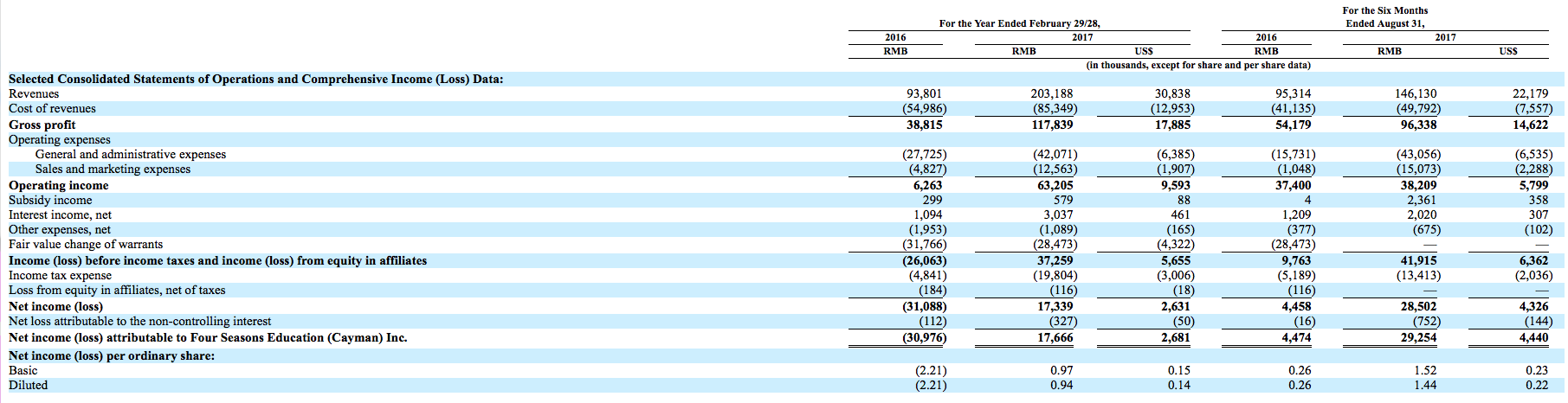

Financials: Their total revenues increased 116.6% from RMB93.8 million in the 2016 fiscal year to RMB203.2 million (US$30.8 million) in the 2017 fiscal year. Their gross profit increased 203.6% from RMB38.8 million in the 2016 fiscal year to RMB117.8 million (US$17.9 million) in the 2017 fiscal year. They improved from net loss of RMB31.1 million in the 2016 fiscal year to net income of RMB17.3 million (US$2.6 million) in the 2017 fiscal year. Their total revenues increased 53.3% from RMB95.3 million for the six months ended August 31, 2016 to RMB146.1 million (US$22.2 million) for the same period in 2017. Their gross profit increased 77.8% from RMB54.2 million for the six months ended August 31, 2016 to RMB96.3 million (US$14.6 million) for the same period in 2017. Their net income increased from RMB4.5 million for the six months ended August 31, 2016 to RMB28.5 million (US$4.3 million) for the same period in 2017.

Competition and Sector Performance:

- RISE Education Cayman Ltd (REDU) — REDU debuted on October 20, 2017 and priced $0.50 above the $12.00-$14.00 pricing. The deal opened with a $1.50 premium at first trade. REDU has been under significant selling pressure and currently trade 7.5% below the offering price at the time of this writing.

- RYB Education, Inc. (RYB) — RYB Education priced its IPO on September 27th at $0.50 above the $16-$18 range and opened with a first trade of $24.12. As of Friday (11/3) afternoon, $RYB was trading more than 40% above its offering price.

- Bright Scholar Education – This operator of the largest operator of international and bilingual K-12 schools in China in terms of student enrollment as of September 1, 2016, according to the Frost & Sullivan report, opened $0.50 above the $10.50 offering price. As of 11.3.17, BEDU is trading 125% above the offering price.

Book-Building Status: The way the book comes together during the week of the roadshow is the bkost critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.