Company: Evoqua Water Technologies Corp.

Symbol: AQUA

Description: They are a leading provider of mission critical water treatment solutions, offering services, systems and technologies to support our customers’ full water lifecycle needs.

Shares: 27.8 million

Range: $17.00-$19.00

Trade Date: 11/2

Underwriter(s): Credit Suisse, J.P Morgan, RBC Capital, Citigroup, Goldman Sachs & Co.

Co-Manager(s): Morgan Stanley, Baird, Raymond James, Stifel, Wells Fargo Securities

Business: With over 200,000 installations worldwide, they hold leading positions in the industrial, commercial and municipal water treatment markets in North America. They offer a comprehensive portfolio of differentiated, proprietary technology solutions sold under a number of market-leading and well-established brands. They deliver and maintain these mission critical solutions through the largest service network in North America assuring their customers continuous uptime with 86 branches which are located no further than a two-hour drive from more than 90% of our customers’ sites. They believe that the customer intimacy created through their service network is a significant competitive advantage.

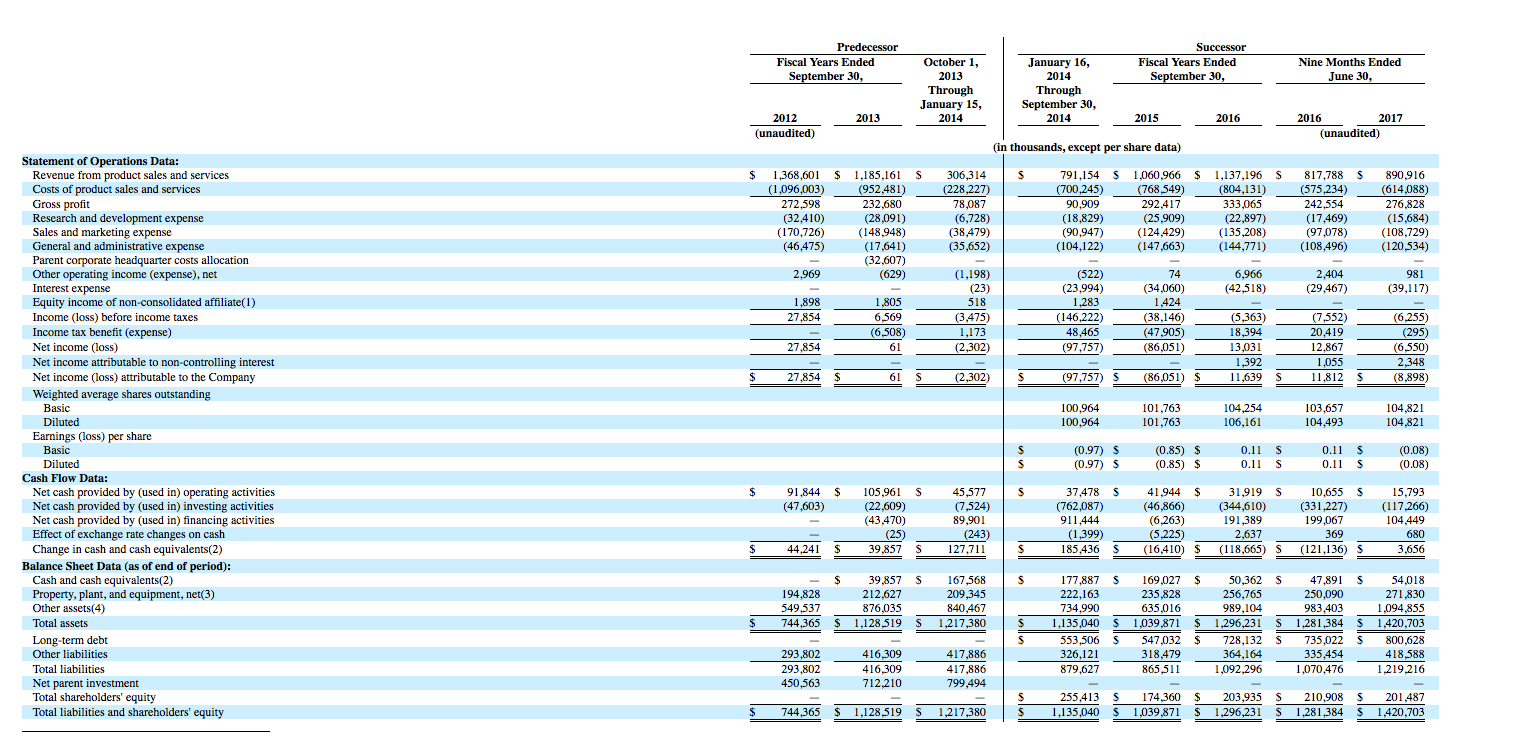

FINANCIALS: Their predecessor and successor revenue from product sales and services was $1.37 billion, $1.19 billion, $1.10 billion, $1.06 billion and $1.14 billion and their net income (loss) was $27.9 million, $61 thousand, ($100.1 million), ($86.1 million), and $13.0 million in fiscal 2012, 2013, 2014, 2015, and 2016, respectively. In the first three quarters of fiscal 2017. Their revenues from product sales and services increased 8.9% to $890.9 million, while their net decreased from a $12.9 million gain to a $6.6 million loss, compared to the same period in fiscal 2016.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.