Company: Esquire Financial Holdings, Inc.

Symbol: ESQ

Description: They are a bank holding company headquartered in Jericho, New York and registered under the Bank Holding Company Act of 1956, as amended (the “BHC Act”).

Shares: 2.5 million

Price Range: $14.00-$16.00

Trade Date: 6/27

Underwriter(s): Sandler O’ Neill + Partners

Investor Access: This deal can be accessed via Sandler O’ Neill.

Business: Their traditional community banking market area has a diversified economy typical of most urban population centers, with the majority of employment provided by services, wholesale/retail trade, finance/insurance/real estate (“FIRE”) and construction. Services account for the largest employment sector across the two primary market area counties, while wholesale/retail trade accounts for the second largest employment sector in Nassau and New York Counties. New York City is one of the premier financial centers in the world, and thus FIRE is the third largest employment sector in New York County. As of June 30, 2016 (the latest date for which information is available), New York County’s $1.0 trillion deposit market was much larger than the $69.8 billion deposit market in Nassau County.

Financials

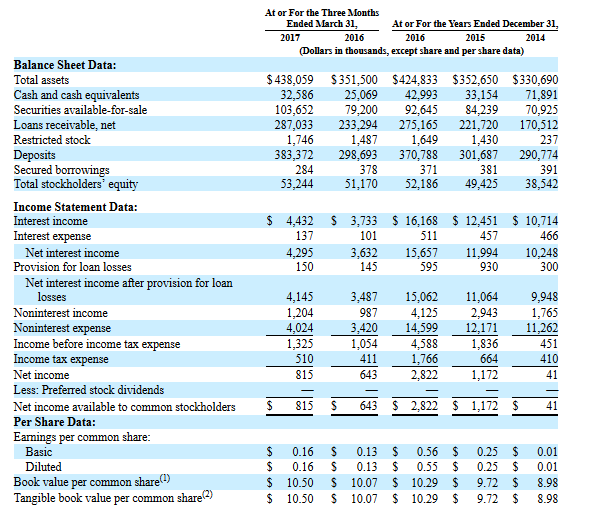

As of March 31, 2017, their total assets, loans, deposits and stockholders’ equity totaled $438.1 million, $290.6 million, $383.4 million and $53.2 million, respectively. For the years ended December 31, 2016 and 2015, their net income increased 140.8% to $2.8 million, or $0.55 per diluted share; they had a net interest margin of 4.25%, an increase from 3.74%, stabilized by a low cost of funds of 0.15% on their deposits; and their loans increased 24.1%, or $54.1 million, to $278.6 million, with no non-performing loans and solid asset quality metrics; their non interest income increased 40.2% to $4.1 million. For the three months ended March 31, 2017 and 2016, their net income increased 26.8% to $815,000 or $0.16 per diluted share; their loans increased 23.0%, or $54.3 million, to $290.6 million, with no non-performing loans and solid asset quality metrics; and their non interest income increased 22.0% to $1.2 million, which represented 21.9% of their total revenue for the three months ended March 31, 2017, primarily driven by their merchant services platform.

Comp / Sector Performance:

Esquire Financial will be the fifth financial sector IPO to come to market this year. The four previous deals have opened, on average, 10.0% above their respective offering prices. It should be noted that two of the deals, Elevate Credit and China Rapid Finance Limited, needed to price well below their original ranges in order to come to market. It has only been Elevate credit that has had a significant pop in the aftermarket as ‘ELVT’ is up more nearly 25% versus its offering price as of noon on Monday (6.26.17).

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.