Company: CURO Group Holdings Corp.

Symbol: CURO

Description: They are a growth-oriented, technology-enabled, highly-diversified consumer finance company serving a wide range of underbanked consumers in the United States, Canada and the United Kingdom and are a market leader in our industry based on revenues.

Shares: 6.67 million

Price Range: $14.00-$16.00

Trade Date: 12/7

Underwriter(s): Credit Suisse, Jefferies, Stephens Inc.

Co-Manager(s): William Blair, Janney Montgomery Scott

Terms Added: 11-28-17

Business: They operate in the United States under two principal brands, “Speedy Cash” and “Rapid Cash,” and launched their new brand “Avio Credit” in the United States in the second quarter of 2017. In the United Kingdom they operate online as “Wage Day Advance” and “Juo Loans” and, prior to their closure in the third quarter of 2017, their stores were branded “Speedy Cash.” In Canada their stores are branded “Cash Money” and they offer “LendDirect” installment loans online. As of September 30, 2017, their store network consisted of 405 locations across 14 U.S. states and seven Canadian provinces. As of September 30, 2017, they offered their online services in 26 U.S. states, five Canadian provinces, and the United Kingdom.

Financials:

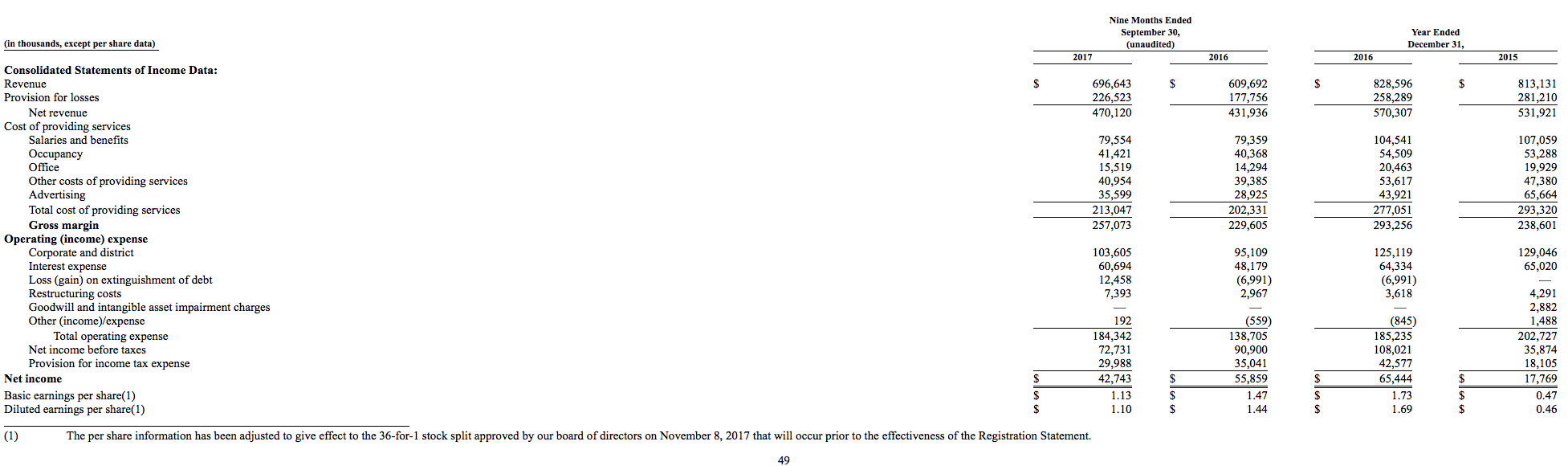

Their revenues were $813.1 million and $828.6 million and their net income was $17.8 million and $65.4 million in 2015 and 2016, respectively. In the first three quarters of 2017, their revenues increased 14.3% to $696.6 million and their net income decreased 23.5% to $42.7 million. The decrease in net income reflects the $12.5 million loss from the extinguishment of debt, due to the redemption of CURO Intermediate’s 10.75% Senior Secured Notes due 2018 and their 12.00% Senior Cash Pay Notes due 2017. For year ended December 31, 2016, a $7.0 million gain resulted from the Company’s purchase of CURO Intermediate’s 10.75% Senior Secured Notes in September 2016.

Book-Building Status: The way the book comes together during the week of the roadshow is the bkost critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.