Company: Central Puerto S.A.

Symbol: CEPU

Description: They are the largest private sector power generation company in Argentina, as measured by generated power, according to data from CAMMESA. Their common shares are listed on the Bolsas y Mercados Argentinos S.A. under the symbol ‘CEPU’.

Shares: 35.4 million ADS

Price Range: $17.50-$21.50

Trade Date: 2/2

Underwriter(s): BofA Merrill Lynch, J.P. Morgan, Morgan Stanley

Terms Added: 1-18-18

Note: Their common shares are listed on the Bolsas y Mercados Argentinos S.A. (the “BYMA”) under the symbol “CEPU.” On January 17, 2018, the last reported sales price of their common shares on the BYMA was Ps.45.50 per common share (equivalent to approximately US$24.14 per ADS based on the exchange rate on such date). Prior to this offering, no public market existed for the ADSs.

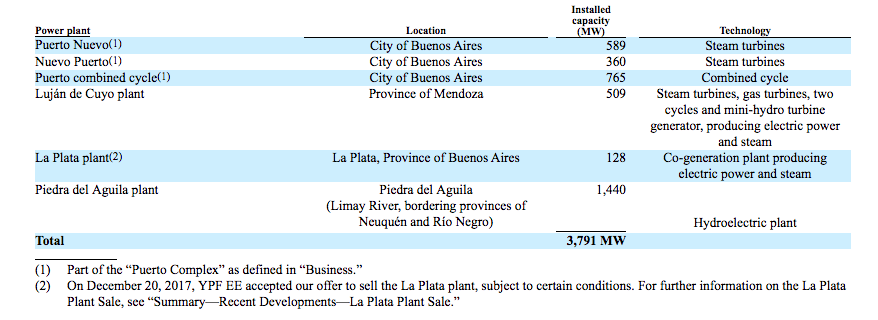

Business: They have a generation asset portfolio that is geographically and technologically diversified. Our facilities are distributed across the City of Buenos Aires and the provinces of Buenos Aires, Mendoza, Neuquén and Río Negro. They use conventional technologies (including hydro power) to generate power, and their power generation assets include combined cycle, gas turbine, steam turbine, hydroelectric and co-generation.

The following table presents a brief description of the power plants they own and operate:

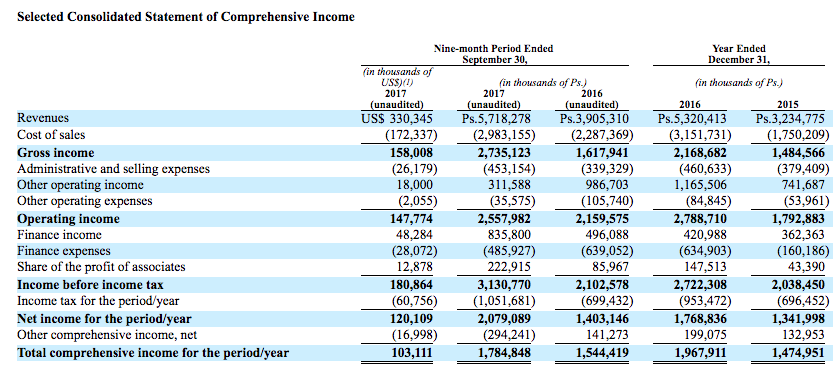

Financials: Their revenue was Ps. 3.23 billion and Ps. 5.32 million and their net income was Ps.1.34 billion and Ps. 1.77 billion in 2015 and 2016, respectively. In the first three quarters of 2017, their revenues increased 46.4% to Ps. 5.72 billion and their net income increased 48.2% to Ps. 2.08 billion, compared to the same period in the previous year.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.