Company: Cardlytics, Inc.

Symbol: CDLX

Description: Cardlytics makes marketing more relevant and measurable through their purchase intelligence platform.

Shares: 5.4 million

Price Range: $13.00-$15.00

Trade Date: 2/9

Underwriter(s): BofA Merrill Lynch, J.P. Morgan

Co-Manager(s): Wells Fargo Securities, SunTrust Robinson Humphrey, Raymond James, KeyBanc Capital Markets

Terms Added: 1-29-18

Business: With purchase data from more than 2,000 financial institutions, they have a secure view into where and when consumers are spending their money. By applying advanced analytics to this massive aggregation of purchase data, they make it actionable, helping marketers identify, reach and influence likely buyers at scale, and measure the true sales impact of their marketing spend. This collection of debit, credit, ACH, and bill pay data represented approximately $1.3 trillion in U.S. consumer spend in 2016. In 2016, their platform analyzed over 18.0 billion online and in-store transactions across more than 94.0 million accounts in the United States, representing one in five debit and credit card swipes in the United States.

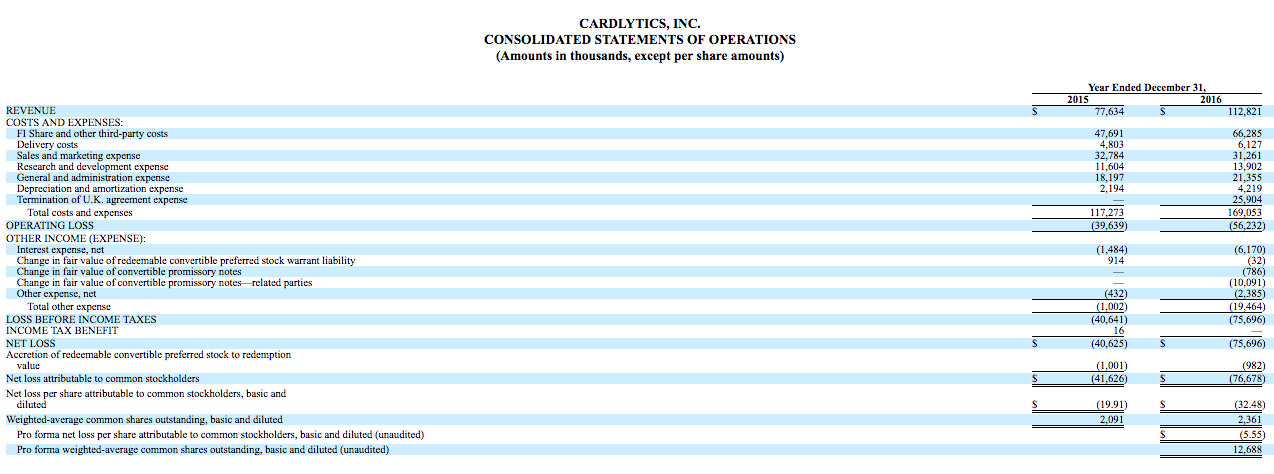

Financials: Their revenue, which excludes consumer incentives, was $53.8 million, $77.6 million and $112.8 million, for 2014, 2015 and 2016, respectively, representing a compound annual growth rate of 44.8%. Their revenue for the nine months ended September 30, 2017 was $91.1 million.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.