Canada Goose (NYSE: GOOS) is set to make its debut as a public company on Thursday. And given the snow storm, the parka-jacket maker can make a case that mother nature has given her blessing on the deal.

But what about IPO investors?

Canada Goose is looking to raise as much as US$240m with 20mm shares being offered at US$10.50-US$12.00.

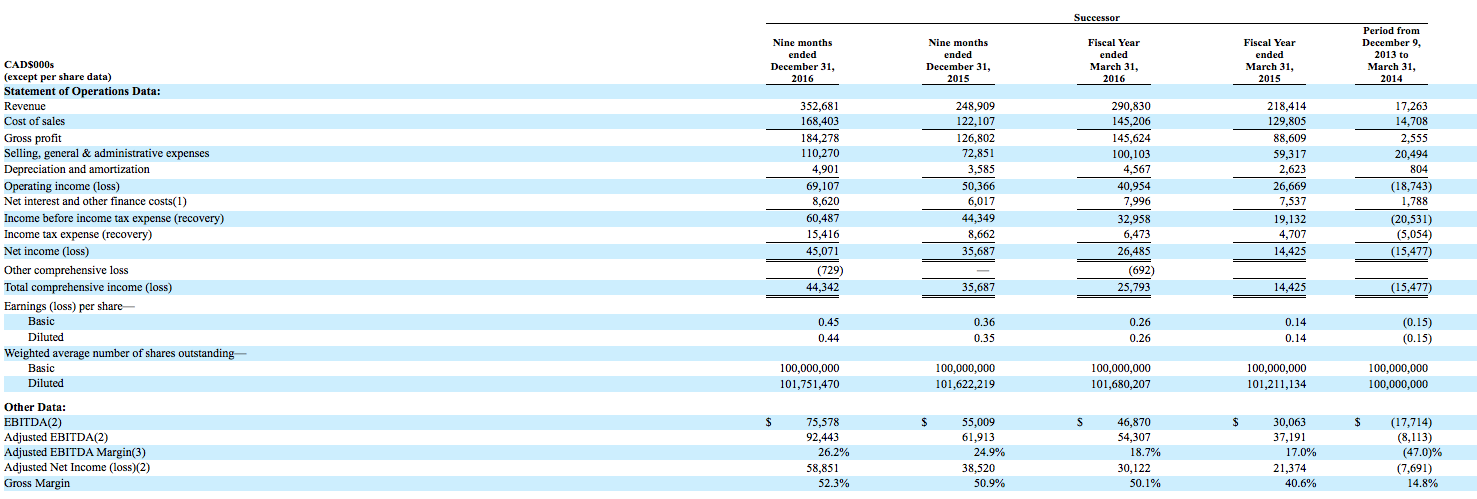

Looking at the financials, Canada Goose grew revenues from $218.4m to $290.8m from FY2015 to FY2016 for a growth of more than 33%. For the nine months ended December 31, 2016 as compared to the same period in 2015…Canada Goose grew revenues 41.6%.

(click to expand)

The numbers are impressive to say the least.

But are investors ready to buy into the long-term for Canada Goose? After all, Canada Goose is in a extremely tough sector of retail apparel that has certainly not been the most ‘in-favor’ sector. While Canada Goose is growing its e-commerce business, they certainly have limited experience in that sector. And furthermore, being that Canada Goose operates in the high-end sector, who is ready to fork over nearly $1,000 for a jacket on-line?

Canada Goose certainly has as brand that is recognizable in the northern half of the United States, but being a parka-maker, the reach is definitely capped.

Not to mention…where are all the global-warming people that say parkas are a thing of the past (half-kidding, of course!)?

And furthermore, Canada Goose has been in the cross-hairs of animal-rights group PETA to protest the company’s use of coyote fur and down.

The channel checks that we have received early-on states there is positive interest in the IPO…but how will the company trade thereafter? Is the brand ‘sticky-enough’ to continues its upward momentum?

These are all questions investors must take into account when considering whether to start a long-term investment in ‘GOOS’.