Company: Byline Bancorp, Inc.

Symbol: BY

Description: They are a bank holding company headquartered in Chicago, Illinois and conduct all their business activities through their subsidiary, Byline Bank, a full service commercial bank.

Shares: 5.7 million

Price Range: $19.00-$21.00

Trade Date: 6/29

Underwriter(s): BofA Merrill Lynch, Keefe Bruyette & Woods

Co-Manager: Piper Jaffray, Sandler O’Neill + Partners, Stephens Inc.

Investor Access: This deal can be accessed via the two main underwriters and the three co-managers.

Business:

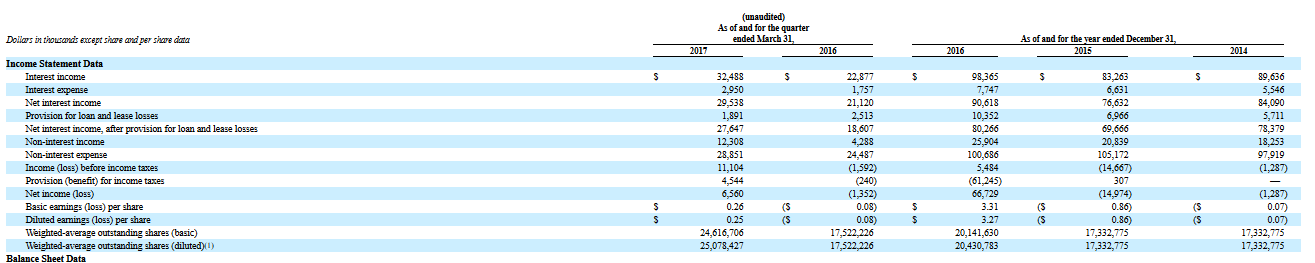

Their net income (loss) was ($1.29 million), ($14.97 million) and $66.73 million in 2014, 2015 and 2016, respectively. In the first quarter of 2017, their net income increased to a $6.56 million gain from a $1.35 million loss, compared to the same period the previous year.

They operate the fifth largest branch network in the City of Chicago with 56 branches in the Chicago metropolitan area. In addition to their traditional commercial banking business, they provide small ticket equipment leasing solutions and were the sixth most active Small Business Administration (“SBA”) lender in the United States. As of March 31, 2017, they had consolidated total assets of $3.3 billion, total gross loans and leases outstanding of $2.1 billion, total deposits of $2.6 billion and total stockholders’ equity of $389.7 million. They distinguish themselves from smaller competitors with the breadth and sophistication of their product capabilities, ranging from basic deposit accounts to cash-flow based loan facilities and cash management products; and they differentiate themselves from larger competitors with their level of responsiveness, local decision making and the accessibility of their service.

Given the market opportunity for a commercial bank of their size and the scarcity of banks within the $2 billion to $10 billion asset range, they see a significant opportunity for Byline to gain market share in the Chicago area. They intend to grow their business organically in a focused and strategic manner.

Financials:

Comp / Sector Performance:

Chicago is the third largest metropolitan area in the U.S. and ranks in the top 10% of the U.S. by median household income. The city boasts a highly educated labor force with more than 508,000 residents with bachelor’s degrees and an influx of approximately 158,000 college graduates annually. Due to its diversified economy, strong labor force and low cost of doing business compared to other large metropolitan areas, more than 400 major corporations are headquartered in Chicago, including 31 Fortune 500 companies. There are over 27,000 small and medium sized businesses in Chicago that generate between $5 million and $75 million in annual revenue, which they view as their target commercial customers. More recently, Chicago was named by KPMG as one of the top 10 technology innovation hubs worldwide, with Chicago based startups and tech companies having raised a combined $3.4 billion in capital in 2015 and 2016.

They believe the lack of similarly sized banks in the Chicago area creates a unique opportunity for them as they strive to provide broader and more sophisticated product capabilities than their smaller competitors while offering more responsive decision making and accessible service to local businesses and consumers than their larger competitors. Given the large number of businesses, the attractive demographics and the lack of medium sized local banks capable of serving small and medium sized businesses in their target market, they believe they are well positioned to capitalize on growth opportunities in this market.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.