Company: Bluegreen Vacations Corporation

Symbol: BXG

Description: They are a leading vacation ownership company that markets and sells vacation ownership interests and manages resorts in top leisure and urban destinations.

Shares: 6.5 million

Price Range: $16.00-$18.00

Trade Date: 11/17

Underwriter(s): Stifel, Credit Suisse

Co-Manager(s): BofA Merrill Lynch, SunTrust Robinson Humphrey

Terms Added: 11-7-17

Business: Resort network includes 43 Club Resorts (resorts in which owners in their Vacation Club have the right to use most of the units in connection with their VOI ownership) and 24 Club Associate Resorts (resorts in which owners in our Vacation Club have the right to use a limited number of units in connection with their VOI ownership). Their Club Resorts and Club Associate Resorts are primarily located in popular, high-volume, “drive-to” vacation locations, including Orlando, Las Vegas, Myrtle Beach and Charleston, among others. Through their points-based system, the approximately 211,000 owners in their Vacation Club have the flexibility to stay at units available at any of their resorts and have access to almost 11,000 other hotels and resorts through partnerships and exchange networks. They have a robust sales and marketing platform supported by exclusive marketing relationships with nationally-recognized consumer brands, such as Bass Pro and Choice Hotels. These marketing relationships drive sales within their core demographic.

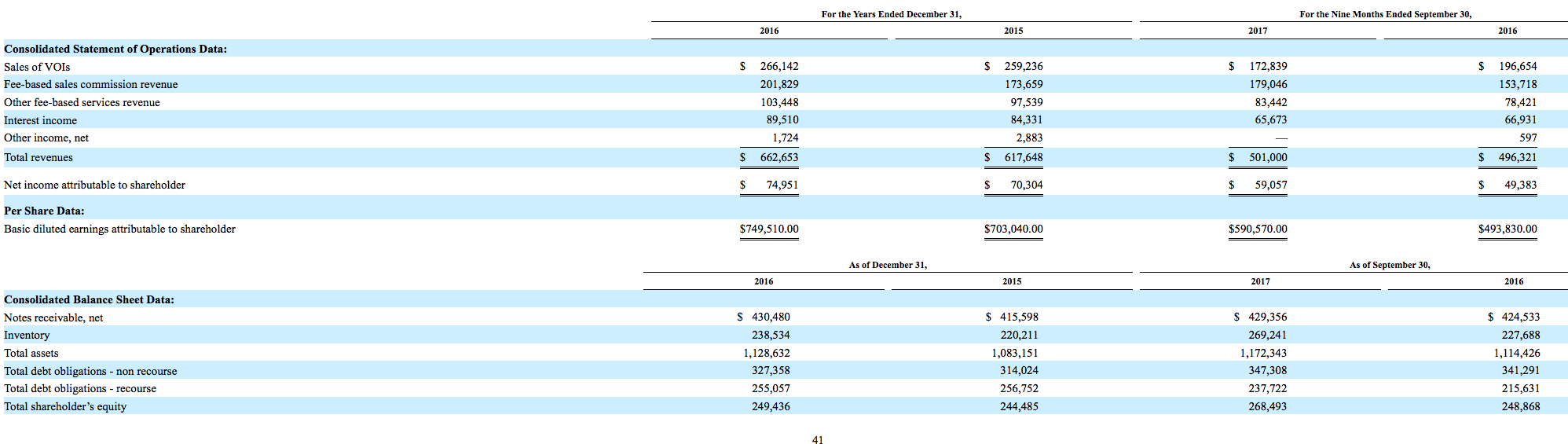

Financials: Their total revenues were $617.6 million and $662.7 million and their net income was $70.3 million and $75.0 million in 2015 and 2016, respectively. In the first three quarters of 2017, their total revenues increased 0.9% to $501 million, and their net income increased 19.6% to $59.1 million, compared to results in the same period in 2016. They intend to pay a quarterly dividend of $0.15 per share, or $0.60 annually, for a projected 3.5% annual return, based on the midpoint of the offering range.

Book-Building Status: The way the book comes together during the week of the roadshow is the bkost critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.