Company: Blue Apron Holdings, Inc.

Symbol: APRN

Description: Blue Apron was founded in 2012 premised on a simple desire our founders wanted to cook at home with their families, but they found grocery shopping and menu planning burdensome, time consuming, and expensive.

Shares: 30 million

Price Range: $15.00-$17.00

Trade Date: 6/29

Underwriter(s): Goldman Sachs & Co., Morgan Stanley, Citigroup, Barclays

Co-Manager: RBC Capital Markets, SunTrust Robinson Humphrey, Stifel, Canaccord Genuity, Needham & Company, Oppenheimer & Co., Raymond James, William Blair

Investor Access: This deal can be accessed via the four main underwriters and the eight co-managers.

Business:

From inception through March 31, 2017, they have delivered over 159 million meals to households across the United States, which represents approximately 25 million paid orders. They offer their customers two flexible plans—their 2-Person Plan and their Family Plan. Their flexible recipe design process allows them to adjust recipes close to the time of delivery, enabling them to coordinate customer preferences with expected ingredient supply to help mitigate supply chain risks.

They believe that they have developed a powerful and emotional connection with their customers through the frequency of their contacts and the experiential nature of their products. They provide their customers with distinct cooking experiences centered on original recipes that their professional culinary team crafts each week, frequently around specialty ingredients cultivated or produced exclusively for them. Their constant product innovation process enables them to deliver the type of variety that their customers expect with the quality that they deserve.

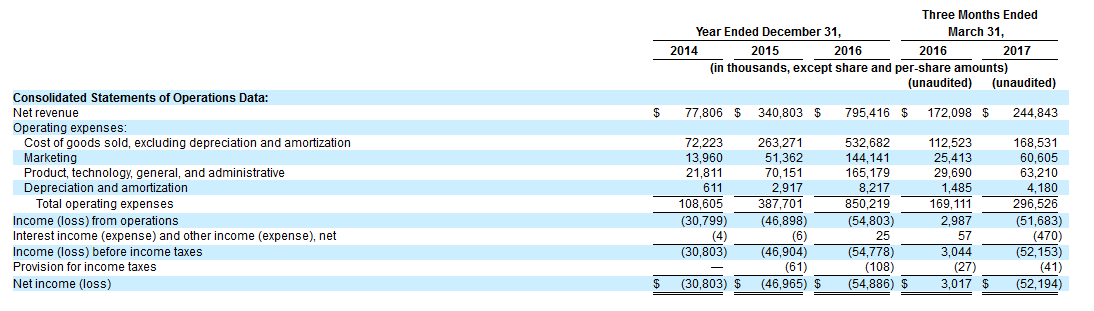

FINANCIALS:

RISK: They have a history of losses, and they may be unable to achieve or sustain profitability. Despite their focus on marketing activities, they may fail to identify cost-efficient marketing opportunities as they scale their investments in marketing or fail to fully understand or estimate the conditions and behaviors that drive customer behavior.

Changes in consumer tastes and preferences or in consumer spending and other economic or financial market conditions could materially adversely affect their business.

Comp / Sector Performance:

Their current and potential competitors include: (1) other food and meal delivery companies; (2) the supermarket industry; (3) a wide array of food retailers, including natural and organic, specialty, conventional, mass, discount, and other food retail formats; (4) conventional supermarkets; (5) other food retailers; (6) online supermarket retailers; (7) casual dining and quick-service restaurants and other food service businesses in the restaurant industry; (8) online wine retailers, wine specialty stores, and retail liquor stores; and (9) food manufacturers, consumer packaged goods companies, providers of logistics services, and other food and ingredient producers.

In 2016, according to a Euromonitor study commissioned by them, aggregate sales in the U.S. grocery market were $781.5 billion, and aggregate sales in the global grocery market were more than eight times larger. For purposes of this study, the grocery market includes retail sales of fresh foods, packaged foods, hot drinks, soft drinks, and alcoholic drinks across grocery retailers, variety stores, warehouses clubs, mass merchandisers, and Internet retailers. According to this study, online sales in 2016 represented only $9.7 billion, or approximately 1.2%, of the overall grocery market in the United States, but are expected to grow at a compound annual growth rate (excluding the impact of price inflation), or CAGR, of 8.5% between 2017 and 2020, compared to the broader grocery market, which is expected to grow at a CAGR of 1.3% in the same period.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.