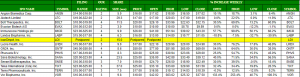

The large quantity of IPOs to come to market this week were met with open arms by investors. Among the 15 IPOs originally on the schedule on Monday, eleven opened in the black, two got out the door flat, two opened below issue and one deal was ultimately postponed.

The best biotech IPO of the week turned out to be one that was thinly traded.

Vor Biopharma Inc (VOR) priced 9.8mm shares (upsized from 8.8mm) at $18.00 (high-end of the range) and opened at $42.02 for a gain of 133.4% at first trade. The opening print got out the door with less than 50,000 shares paired. In the first hour of trading, VOR hit a high of $46.22 and a low of $25.32 — enough action to make traders sick. But the fireworks did not stop there. VOR traded to as high as $63.62 for a gain of 253.4% at top tick!

Bolt Therapeutics Inc (BOLT) priced 11.5mm shares (upsized for the second time) at $20.00 ($1.00 Above Range) and opened at $26.10 for a gain of 30.5% at first trade. The stock traded very well in its opening session and closed Friday at $32.15 or 60.8% above the issue price.

Immunocore Holdings plc (IMCR) priced 9.9mm shares (upsized from 8.33mm) at $26.00 ($1 Above Range) and opened at $41.00 for a gain of 57.7% at first trade. IMCR held steady during its debut session and closed the week at $43.20 or 66.2% above the offering price.

Sana Biotechnology Inc (SANA) priced 23.5mm shares (upsized a second time) at $25.00 ($1 above the upwardly-revised range) and opened at $35.00 for a gain of 40.0% at first trade. SANA traded above its opening print for most of the week and closed Friday at $39.12 or 56.5% above the offering price.

Sensei Biotherapeutics, Inc. (SNSE) priced 7.0mm shares (upsized from 5.9mm) at $19.00 ($1.00 above range) and opened at $24.70 for a gain of 30.0% at first trade.

Lucira Health Inc (LHDX) priced 9.0mm shares (upsized from 7.8mm) at $17.00 (high-end of the range) and opened at $22.10 for a gain of 30.0% at first trade. #IPO $LHDX

Pharvaris B.V. (PHVS) priced 8.3mm shares (upsized from 6.95mm) at $20.00 ($1 Above Range) and opened at $25.00 for a gain of 25.0% at first trade.

Angion Biomedica Corp (ANGN) priced 5.0mm shares at $16.00 (high-end of the range) and opened at $17.62 for a gain of 10.1% at first trade.

Evaxion Biotech A/S (EVAX) priced 3.0mm shares (upsized from 2.75mm) at the low-end of the range, $10.00, and opened at $10.00 (flat).

Terns Pharmaceuticals, Inc. (TERN) priced 7.5mm shares (upsized from 6.25mm) at the high-end of the range, $17.00, and opened at $16.95 for a loss of 0.3% at first trade. TERN ended up being a turn-around story as the stock got through the offering price and closed the week at $18.39 or 8.2% above the offering price.

Landos Biopharma, Inc. (LABP) priced a full size deal, 6.25mm shares, at the midpoint of the range, $16.00, and opened at $13.00 for a loss of 18.8% at first trade. This stock traded the worst of the biotech bunch and closed the week at -30.9% with a closing print of $11.05.

ON24 Inc (ONTF) priced a full-size deal, 8.6mm shares, at the high-end of the range, $50.00, and opened at $77.00 for a gain of 54.0% at first trade.

Telus International (Cda) Inc. (TIXT ) priced 37.0mm shares (upsized from 33.3mm) at $25.00 (high-end of the range) and opened at $33.10 for a gain of 32.4% at first trade.

Atotech Limited (ATC) priced 29.3mm shares at $17.00 ($2 below range) and opened at $17.00 (flat).

Loan Depot Inc (LDI) – According to underwriter guidance, this offering has been postponed. There is no further information available at this time.

Looking ahead to next week, there are currently eight deals on the schedule:

Debuting Tuesday (2/9)

Adagene Inc. (ADAG) — They are a platform-driven, clinical-stage biopharmaceutical company committed to transforming the discovery and development of novel antibody-based cancer immunotherapies.

Cloopen Group Holding Limited (RAAS) — They are the largest multi-capability cloud-based communications solution provider in China, as measured by revenues in 2019, according to the CIC report.

Debuting Wednesday (2/10)

Viant Technology Inc (DSP) — They are an advertising software company. Their software enables the programmatic purchase of advertising, which is the electronification of the advertising buying process.

Debut Thursday (2/11)

Apria Inc. (APR) — They are a leading provider of integrated home healthcare equipment and related services in the United States.

AFC Gamma Inc (AFCG) — AFC Gamma, Inc. is a commercial real estate finance company founded in July 2020 by a veteran team of investment professionals.

Bioventus Inc (BVS) — They are a global medical device company focused on developing and commercializing clinically differentiated, cost efficient and minimally invasive treatments that engage and enhance the body’s natural healing process.

Bumble Inc (BMBL) — The Bumble brand was built with women at the center—where women make the first move.

Signify Health Inc (SGFY) — Signify Health is a leading healthcare platform that leverages advanced analytics, technology, and nationwide healthcare provider networks to create and power value-based payment programs.