Company: Bioceres S.A.

Symbol: BIOX

Description: They are a fully-integrated provider of crop productivity solutions, including seeds, seed traits, seed treatments, biologicals, high-value adjuvants and fertilizers.

Shares: 11.8 million

Price Range: $10.00-$12.00

Trade Date: 2/7

Underwriter(s): Jefferies, Piper Jaffray, Santander, SunTrust Robinson Humprhey

Co-Manager: Mirabaud Securities

Terms Added: 1-23-18

Business: Unlike most industry participants that specialize in a single technology, chemistry, product, condition or stage of plant development, this company has developed a multi-discipline and multi-product platform capable of providing solutions throughout the entire crop cycle, from pre-planting to transportation and storage. Their platform is designed to cost-effectively bring high-value technologies to market through an open-architecture approach.

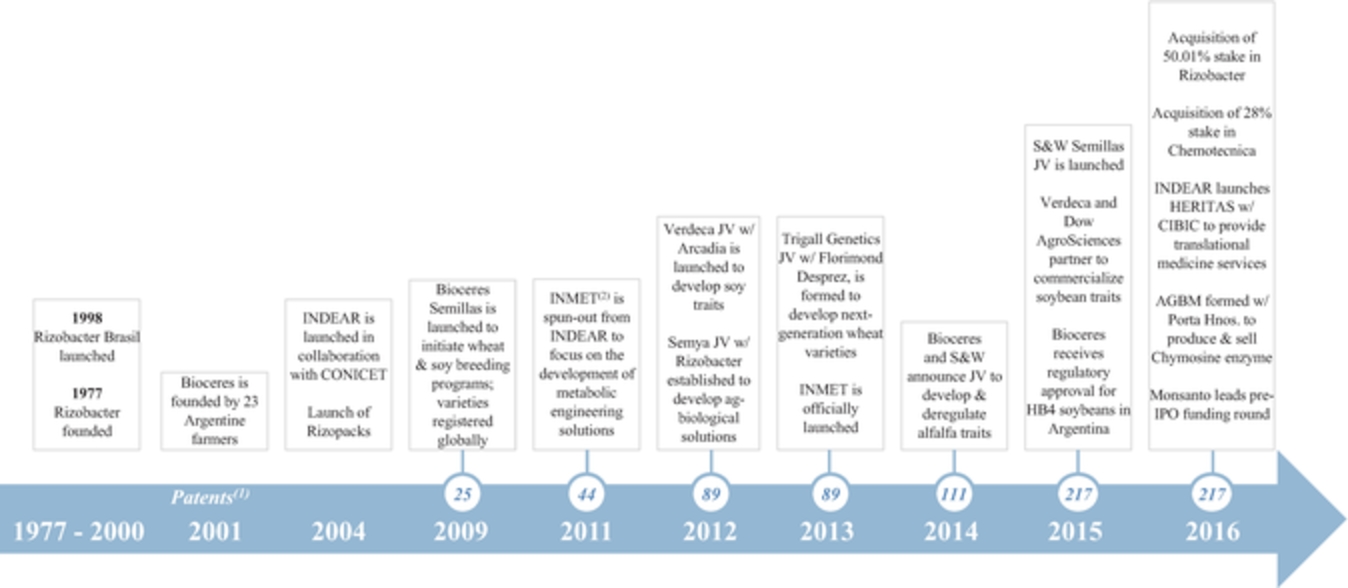

Chart of Innovation:

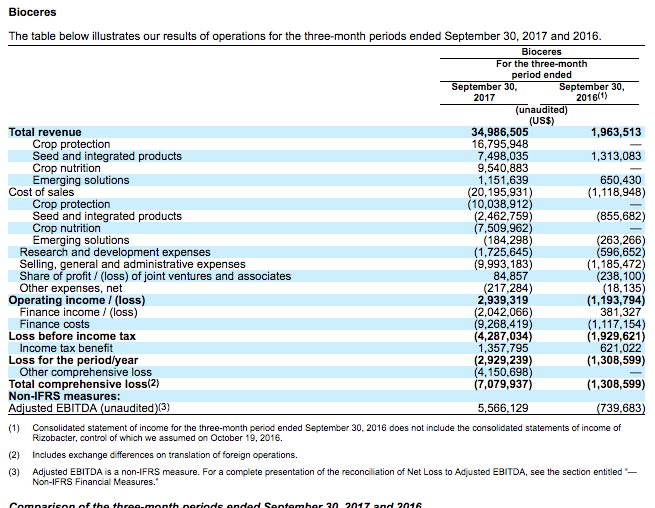

Financials: Their total revenues were $10.20 million and $44.35 million, and their loss was $3.73 million and $9.71 million in 2015 and 2016, respectively. In the quarter September 30, their total revenue were $1.96 million and $34.99 million and their loss was $1.31 million and $7.08 million in 2016 and 2017, respectively. The comparability of their results of operations is affected by the consummation of their acquisition of Rizobacter, which was consummated on October 19, 2016. Their results of operations for periods prior to the acquisition date do not include the results of Rizobacter and therefore are not comparable to their results for periods after this date.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.