Company: BEST, Inc.

Symbol: BSTI

Description: They enable New Retail. They are Smart Supply Chain. They strive to deliver the BEST experience to their ecosystem participants.

Shares: 62.1 million ADS

Range: $13.00-$15.00

Trade Date: 9/20

Underwriter(s): Citigroup, Credit Suisse, Goldman Sachs, J.P. Morgan, Deutsche Bank

Co-Manager(s): CITIC CLSA, KeyBanc Capital Markets, Oppenheimer & Co., Stifel

Investor Access: This deal can be accessed via the five main underwriters.

Business: Their multi-sided platform combines technology, integrated logistics and supply chain services, last-mile services and value-added services. BEST Cloud, their proprietary technology platform that seamlessly connects their systems with those of their ecosystem participants, is the backbone that powers their integrated services and solutions. Their logistics and supply chain services encompass B2B and B2C supply chain management, express and less-than-truckload delivery, cross-border supply chain management and a real-time bidding platform to source truckload capacity. Their last-mile services include online merchandise sourcing and store management for convenience stores as well as B2C services. In addition, they provide value-added services to support our ecosystem participants and help them grow.

Addressable Market:

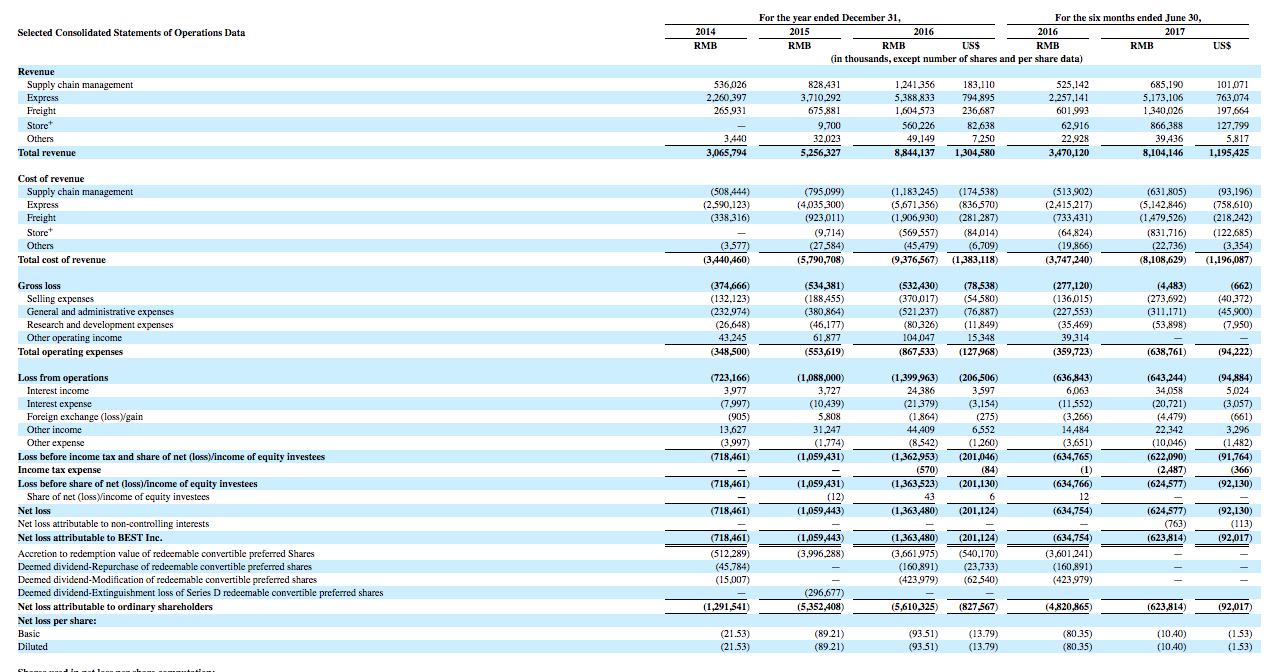

FINANCIALS: Their total revenue increased by 71.5% from RMB3,065.8 million in 2014 to RMB5,256.3 million in 2015, and further increased by 68.3% to RMB8,844.1 million (US$1,304.6 million) in 2016. Their total revenue increased by 133.5% from RMB3,470.1 million in the six months ended June 30, 2016 to RMB8,104.1 million (US$1,195.4 million) in the same period in 2017. They had net losses of RMB718.5 million, RMB1,059.4 million and RMB1,363.5 million (US$201.1 million) in 2014, 2015 and 2016, respectively, and RMB634.8 million and RMB624.6 million (US$92.1 million) in the six months ended June 30, 2016 and 2017, respectively. Their gross margin has improved from negative 12.2% in 2014 to negative 10.2% in 2015 and further to negative 6.0% in 2016, and from negative 8.0% to negative 0.1% in the six months ended June 30, 2016 and 2017, respectively, as a result of operating leverage and improved operating efficiency.

Strategic Relationships: They have strategic relationships with Alibaba, their largest shareholder, and Cainiao Network, has provided us with valuable access to the world’s largest online and mobile commerce platform. They are one of Cainiao Network’s logistics partners for new business initiatives and services. Alibaba owns 23.4% of the outstanding shares in this company prior to this offering and is not selling a share in this IPO.

Competition and Sector Performance: The company Best, Inc. is most compared with is ZTO Express (NYSE: ZTO) which had the most disappointing IPO of 2016. ZTO opened 5.6% below the offering price and has yet to log a trade above the $19.50 offering price. As of the close on September 13, ZTO Express was trading at $14.21 or 27.1% below the offering price.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of September by clicking here.

Indicate with confidence, SUBSCRIBE today.