Company: Aquantia Corp.

Symbol: AQ

Description: They are a leader in the design, development and marketing of advanced high-speed communications integrated circuits, or ICs, for Ethernet connectivity in the data center, enterprise infrastructure and access markets.

Shares: 6.8 million

Price Range: $10.00-$12.00

Trade Date: 11/3

Underwriter(s): Morgan Stanley, Barclays, Deutsche Bank Securities

Co-Manager(s): Needham & Co., Raymond James

Business: Their Ethernet solutions provide a critical interface between the high-speed analog signals transported over wired infrastructure and the digital information used in computing and networking equipment. Their products are designed to cost-effectively deliver leading-edge data speeds for use in the latest generation of communications infrastructure to alleviate network bandwidth bottlenecks caused by the exponential growth of global Internet Protocol, or IP, traffic. Many of Aquantia Corp’s semiconductor solutions have established benchmarks in the industry in terms of performance, power consumption and density. Their innovative solutions enable our customers to differentiate their product offerings, position themselves to gain market share and drive the ongoing equipment infrastructure upgrade cycles in the data center, enterprise infrastructure and access markets.

Customers: Their end customers include Aruba (acquired by Hewlett-Packard Enterprise in 2015), Brocade, Cisco, Dell, Hewlett-Packard Enterprise, Huawei, Intel, Juniper, Oracle and Ruckus (acquired by Brocade in 2016).

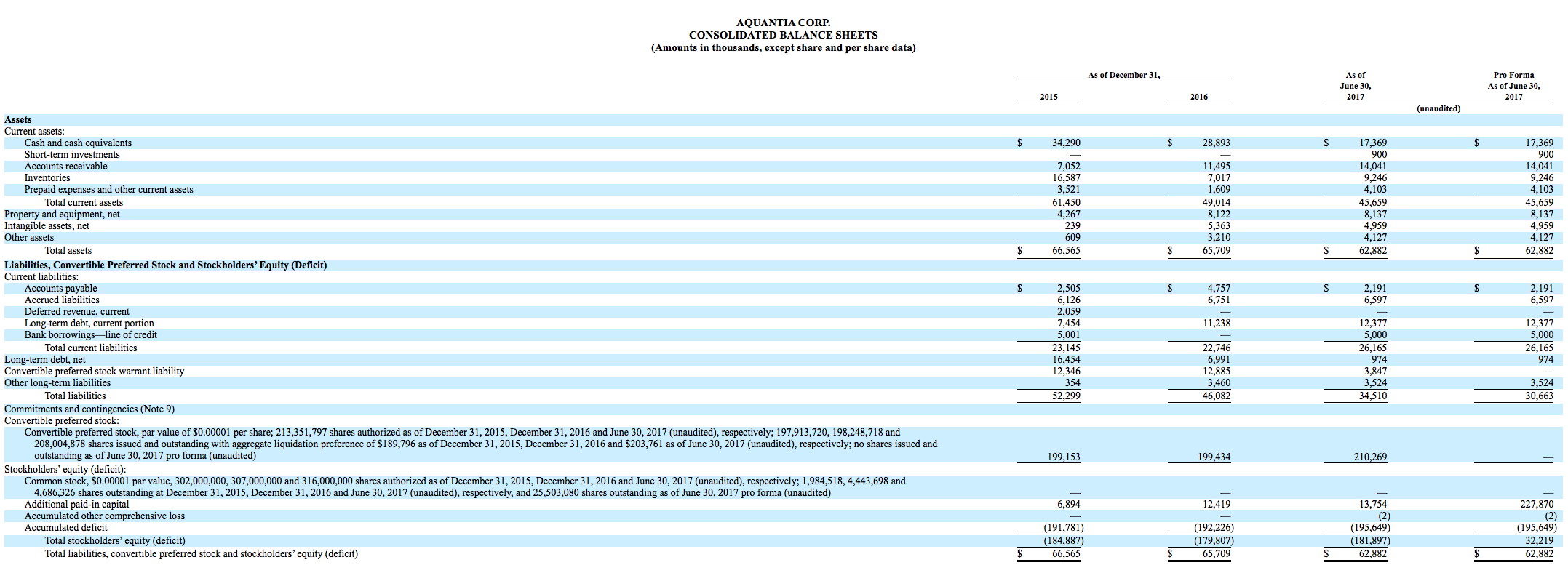

FINANCIALS: For the years ended December 31, 2014, 2015 and 2016 and the six months ended June 30, 2017, sales to Intel accounted for approximately 68%, 78%, 68% and 65% of their revenue, respectively. For the years ended December 31, 2014, 2015 and 2016, their revenue was $24.5 million, $80.8 million and $86.7 million, respectively, their net loss attributable to common stockholders was $27.8 million, $10.0 million and $0.4 million, respectively, and their non-GAAP net income (loss) was $(26.8) million, $1.3 million and $1.1 million, respectively. For the six months ended June 30, 2016 and 2017, their revenue was $41.4 million and $48.8 million, respectively, their net loss attributable to common stockholders was $0.7 million and $3.4 million, respectively, and their non-GAAP net loss was $0.3 million and $1.1 million, respectively.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.