Company: Apellis Pharmaceuticals

Symbol: APLS

Description: They are a clinical-stage biopharmaceutical company focused on the discovery and development of novel therapeutic compounds for autoimmune and inflammatory diseases.

Shares: 10.7 million

Price Range: $13.00-$15.00

Trade Date: 11/9

Underwriter(s): Citigroup, J.P. Morgan, Evercore ISI

Filed 10-20-17

Business: They have the most advanced clinical program targeting C3. They believe that their lead product candidate, APL-2, has the potential to be a best-in-class treatment that may address the limitations of existing treatment options or provide a treatment option where there currently is none. APL-2 has already shown activity that they believe is clinically meaningful in clinical trials for two distinct medical conditions—geographic atrophy in age-related macular degeneration, or GA, and paroxysmal nocturnal hemoglobinuria, or PNH—and they plan to conduct clinical trials in additional complement-dependent diseases. In their ongoing Phase 2 trial of APL-2 in patients with GA, treatment with APL-2 resulted in a significant reduction in the rate of GA lesion growth over 12 months, and in their two ongoing Phase 1b trials in PNH, APL-2 achieved improvements in transfusion dependency, hemoglobin levels and other hematological indicators that they believe are clinically meaningful. They are also developing other novel compounds targeting C3. They hold worldwide commercialization rights to APL-2 and these other novel compounds targeting C3.

Insider Buying: Certain of their existing shareholders, including certain of their directors and affiliates of their directors, and their affiliated entities have indicated an interest in purchasing an aggregate of up to approximately $70.0 million of their common shares in this offering at the initial public offering price per share.

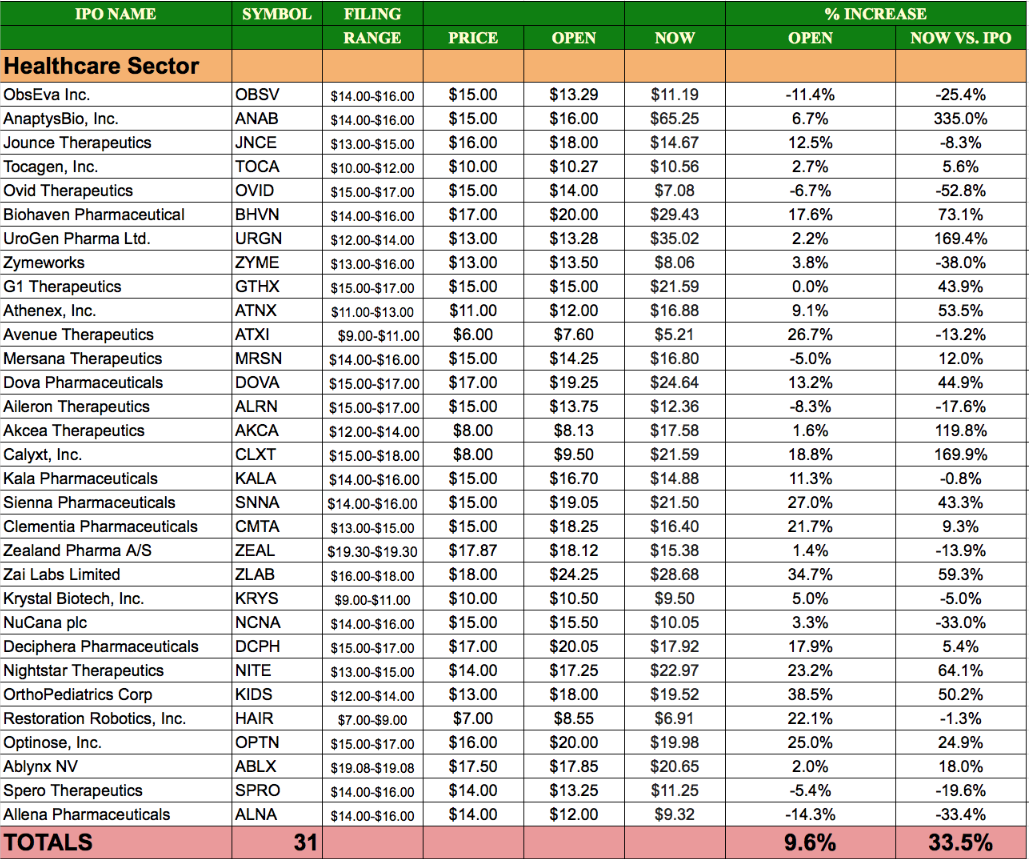

Healthcare IPOs in 2017

Book-Building Status: The way the book comes together during the week of the roadshow is the bkost critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.