Company: Altair Engineering, Inc

Symbol: ALTR

Description: They are a leading provider of enterprise-class engineering software enabling innovation across the entire product lifecycle from concept design to in-service operation.

Shares: 12 million

Price Range: $11.00-$13.00

Trade Date: 11/1

Underwriter(s): J.P. Morgan, RBC Capital Markets, Deutsche Bank Securities

Co-Manager(s): William Blair, Canaccord Genuity

Terms Added: 10-19-17

Business:

Their engineering and design platform offers a wide range of multi-disciplinary computer aided engineering, or CAE, solutions which we believe is one of the most innovative and comprehensive offerings available in the market. To ensure customer success and deepen their relationships with them, they engage with customers to provide consulting, implementation services, training, and support, especially when applying optimization. Altair Engineering participates in five software categories related to CAE and high performance computing, or HPC:

- Solvers & Optimization

- Modeling & Visualization

- Industrial & Concept Design

- Internet of Things (IoT)

- HPC

Altair also provides client engineering services, or CES, to support our customers with long-term ongoing product design and development expertise. This has the benefit of embedding them within customers, deepening their understanding of their processes, and allowing Altair to more quickly perceive trends in the overall market. Altair’s presence at our customers’ sites helps them to better tailor their software products’ research and development, or R&D, and sales initiatives.

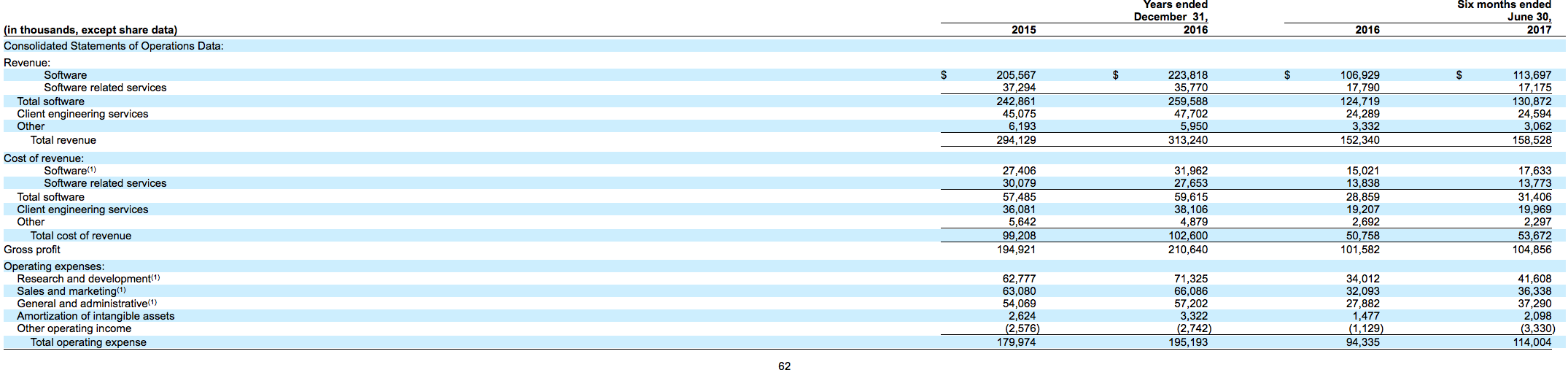

FINANCIALS: Their total revenue was $294.1 million and $313.2 million and their net income was 10.9 million and $10.2 million in 2015 and 2016, respectively. In the first half of 2017, their total revenue increased 4.1% to $158.5 million, and their net income dropped from a $3.95 million gain to a $9.43 million loss.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.