Company: Allena Pharmaceuticals, Inc.

Symbol: ALNA

Description: They are a late-stage clinical biopharmaceutical company dedicated to developing and commercializing first-in-class, oral enzyme therapeutics to treat patients with rare and severe metabolic and kidney disorders.

Shares: 5.3 million

Price Range: $14.00-$16.00

Trade Date: 11/2

Underwriter(s): Credit Suisse, Jefferies, Cowen & Company

Co-Manager(s): Wedbush PacGrow

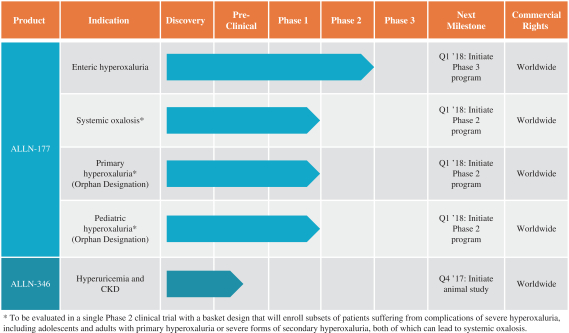

Business: They are focused on metabolic disorders that result in excess accumulation of certain metabolites, such as oxalate and urate, that can cause kidney stones, damage the kidney, and potentially lead to chronic kidney disease, or CKD, and end-stage renal disease. Their lead product candidate, ALLN-177, is a first-in-class, oral enzyme therapeutic that they are developing for the treatment of hyperoxaluria, a metabolic disorder characterized by markedly elevated urinary oxalate levels and commonly associated with kidney stones, CKD and other serious kidney diseases. There are currently no approved therapies for the treatment of hyperoxaluria. They have conducted a robust clinical development program of ALLN-177, including three Phase 2 clinical trials, and Allena Pharmaceuticals expects to initiate the first of two planned pivotal Phase 3 clinical trials for ALLN-177 in the first quarter of 2018, with topline data anticipated in the second half of 2019.

Insider Buying: Certain of their existing stockholders, including certain affiliates of their directors, have indicated an interest in purchasing an aggregate of approximately $25.0 million of shares of common stock in this offering at the initial public offering price.

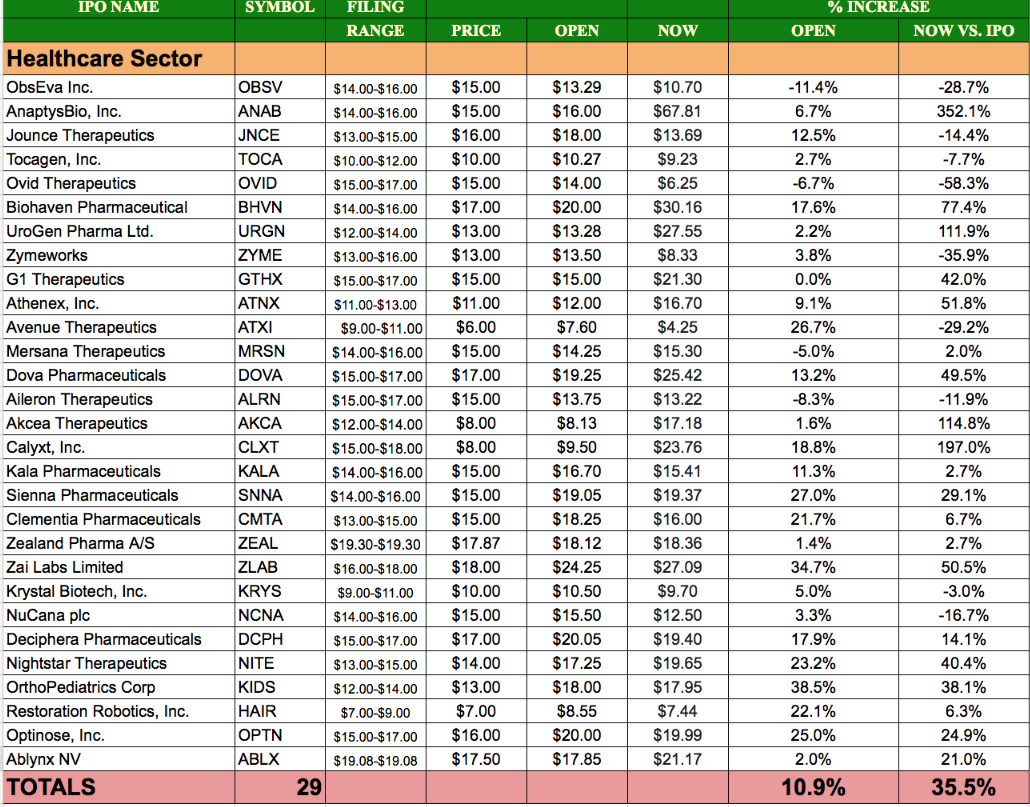

Sector Performance: Below is a chart of the Healthcare sector of the IPO market in 2017 for companies that raised greater than $25m. Prices are as of the close 10.26.17.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.