Company: Akcea Therapeutics, Inc.

Symbol: AKCA

Description: They are a late-stage biopharmaceutical company focused on developing and commercializing drugs to treat patients with serious cardiometabolic diseases caused by lipid disorders.

Shares: 9.62 million

Price Range: $12.00-$14.00

Trade Date: 6/30

Underwriter(s): Cowen and Company, Stifel, Wells Fargo Securities

Co-Manager: BMO Capital Markets

Investor Access: This deal can be accessed via the three main underwriters and the co-manager.

Business:

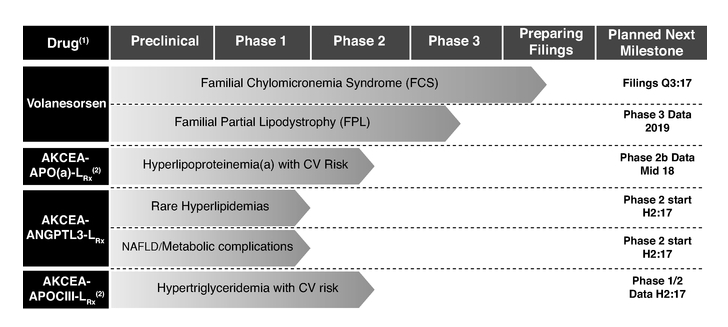

Their goal is to become the premier company offering treatments for inadequately treated lipid disorders. They are advancing a mature pipeline of four novel drugs with the potential to treat multiple diseases. Their drugs, volanesorsen, AKCEA-APO(a)-L Rx , AKCEA-ANGPTL3- L Rx and AKCEA-APOCIII- L Rx , are all based on antisense technology developed by Ionis Pharmaceuticals, Inc., or Ionis.

Their most advanced drug, volanesorsen, has completed a Phase 3 clinical program for the treatment of familial chylomicronemia syndrome, or FCS, and is currently in Phase 3 clinical development for the treatment of familial partial lipodystrophy, or FPL. FCS and FPL are both severe, rare, genetically defined lipid disorders characterized by extremely elevated levels of triglycerides. Both diseases have life-threatening consequences and the lives of patients with these diseases are impacted daily by the associated symptoms. In their clinical program, they have observed consistent and substantial (>70%) decreases in triglycerides and improvements in other manifestations of FCS, including pancreatitis attacks and abdominal pain.

Collaboration:

This company has a collaboration with Novartis Pharma AG — this according to the prospectus:

“To maximize the commercial potential of two of the drugs in their pipeline, they initiated a strategic collaboration with Novartis Pharma AG, or Novartis, for the development and commercialization of AKCEA-APO(a)-LRx and AKCEA-APOCIII-LRx. They believe Novartis brings significant resources and expertise to the collaboration that can accelerate their ability to deliver these potential therapies to the large populations of patients who have high cardiovascular risk due to inadequately treated lipid disorders.”

Comp / Sector Performance:

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.