Company: Aileron Therapeutics, Inc.

Symbol: ALRN

Description: They are a clinical-stage biopharmaceutical company that is focused on developing and commercializing a novel class of therapeutics called stapled peptides.

Shares: 3.75 million

Price Range: $15.00-$17.00

Trade Date: 6/29

Underwriter(s): BofA Merrill Lynch, Jefferies

Co-Manager: William Blair, Canaccord Genuity

Investor Access: This deal can be accessed via the two main underwriters and the two co-managers.

Business:

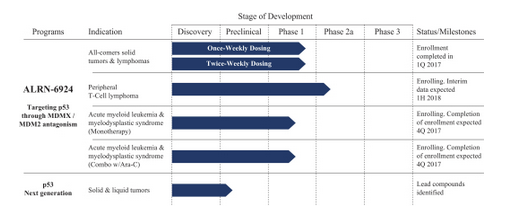

Their lead product candidate, ALRN-6924, targets the tumor suppressor p53 for the treatment of a wide variety of cancers. Their ongoing clinical trials of ALRN-6924 consist of a Phase 1 trial for the treatment of advanced solid tumors or lymphomas, a Phase 2a trial for the treatment of peripheral T-cell lymphoma, or PTCL, a Phase 1 trial for the treatment of acute myeloid leukemia, or AML, and advanced myelodysplastic syndrome, or MDS, as a monotherapy and a Phase 1b trial for the treatment of AML/MDS in combination with cytosine arabinoside, or Ara-C. Of the 62 evaluable patients in their Phase 1 trial for the treatment of advanced solid tumors or lymphomas, as of May 1, 2017, 30 patients (or 48%) demonstrated disease control, consisting of two patients who achieved complete responses, two patients who achieved partial responses and 26 patients who achieved stable disease, with 46% of stable disease patients experiencing shrinkage of the tumor.

They believe that, based on preclinical data and preliminary evidence of safety and anti-tumor activity in their ongoing clinical trials, there may be a significant opportunity to develop ALRN-6924 as a monotherapy or combination therapy for a wide variety of solid and liquid tumors.They plan to advance their lead product candidate, ALRN-6924, in a broad range of solid and liquid tumors, focusing on areas in which they believe ALRN-6924 may have anti-tumor activity and in which there are significant unmet medical needs. They plan to conduct, alone or in collaboration with third parties, additional clinical trials of ALRN-6924, as warranted by the clinical data. They believe that ALRN-6924 is the first and only product candidate in clinical development that can bind to and disrupt the interaction of MDMX and MDM2 with p53 with equivalent effectiveness, or equipotently.

Their stapled peptide drugs may be able to address historically undruggable targets and complex mechanisms, such as intracellular protein-protein interactions like p53, which underlie many diseases with high unmet medical need. In their clinical trials they have observed preliminary evidence of anti-tumor activity across a broad spectrum of cancer patients, durable effect by trial responders and, to date, a favorable safety profile. They may seek discussions with the U.S. Food and Drug Administration, or FDA, regarding the possibility of an expedited clinical development and registration pathway for ALRN-6924 in PTCL patients and the design of a single agent pivotal Phase 2/3 clinical trial as early as the first half of 2018. By targeting a downstream pathway like p53 that is critical and preserved across a multitude of different cancers, their approach may allow for utility in a broader set of cancer patients.

Their most advanced drug, volanesorsen, has completed a Phase 3 clinical program for the treatment of familial chylomicronemia syndrome, or FCS, and is currently in Phase 3 clinical development for the treatment of familial partial lipodystrophy, or FPL. FCS and FPL are both severe, rare, genetically defined lipid disorders characterized by extremely elevated levels of triglycerides

Comp / Sector Performance:

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.