SUBSCRIBE TO IPOBoutique’s Free Weekly Newsletter

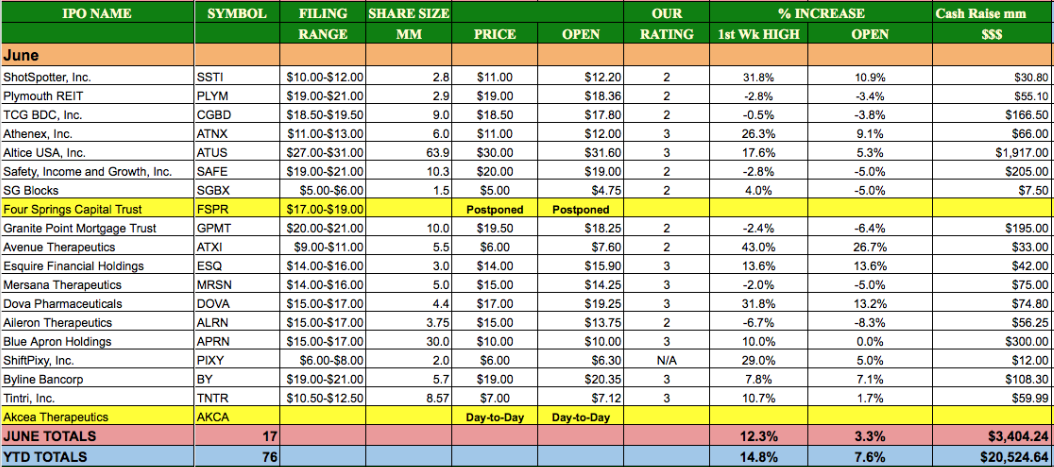

It was a third consecutive strong month for IPO activity as June 17 companies come to market, however, the success of these deals were a mixed bag. Six of the 17 IPOs in the month opened below the offering price and a trio of deals had to severely cut their price range with official filings in order to come to market.

Healthcare was the most prevalent sector in June seeing five deals come to market with an average return of 7.1% at first trade. This included June’s best deal, Avenue Therapeutics (Nasdaq: ATXI), which opened 26.7% higher after pricing three dollars below its original range. Two healthcare offerings, Mersana Therapeutics (Nasdaq: MRSN) and Aileron Therapeutics (Nasdaq: ALRN), opened below their offering prices and remain there a full week into July.

June will also be remembered for the debut of Altice USA, Inc. (NYSE: ATUS) who upsized its offering with a cash raise of $1.9bn by pricing 63.9mm shares at $30.00. $ATUS opened with a $1.60 premium at first trade (5.3% higher) and hit a first week high of 17% above the offering price. Altice USA was the third $1bn+ cash raise in 2017 thus far.

Financial companies continued to be consistent performers with the best of the bunch being a 13.6% return at first trade from Esquire Financial Holdings Inc (NASDAQ: ESQ).

Compared to 2016, the IPO market is well-ahead of last year’s pace. There have been 76 deals that have come to the market in 2017 versus 37 that came to market in this same period in 2016.

This recap will allow us to post our results and emphasize the value of IPOBoutique’s senior managing partner Scott Sweet’s ratings. You can check out our entire track record at this link.

Five-Rating

We consider these IPOs to be the best of the best. In our nine years of keeping a track-record we have given just 14 ‘five-ratings’ and all 14 have hit their respective targets. However, in June 2017, we did not give a ‘five’ rating.

Four-Rating

We consider these IPOs to be very strong buys and we anticipate 1-to-2 points of premium or higher in the first week of trading. However, in June 2017, we did not give a ‘four’ rating.

Three-Rating

We consider these IPOs to be moderate buys and we anticipate 1/2 to 1 point premium or more likely in the cases of these new issues. This past month eight deals debuted that we rated as a ‘three’ with an average return of 5.63% above the offering price. The best ‘3’ rated deal this month was Esquire Financial Holdings Inc (NASDAQ: ESQ) which opened $1.90 above its $14.00 offering price for a 13.6% gain at first trade. We have given 37 IPOs in 2017 a ‘3’ rating and those have produced, on average, a premium of $1.05 above the offering price at first trade.

Two-Rating

We consider these IPOs to be “neutral” and thus do not have a particular point threshold to hit in order for us to deem it as ‘hitting its target’. We gave eight deals a ‘two-rating’ this past month and these deals had an average return of 0.71% above the offering price at first trade. So far in 2017 we have given a total of 29 IPOs a ‘2’ rating and they have produced, on average, just a $0.20 return above the offering price at first trade.

One-Rating

We advise our subscribers to avoid these IPOs as we consider them to be risky. In our nine years of keeping a track-record we have given just 49 ‘one’ ratings. In June, we did not give a ‘one’ rating.

IPOBoutique.com provides comprehensive research, ratings and daily advisories on new issues hitting the IPO market.

To subscribe to IPOBoutique’s service: click here.