2016 US IPO Market Analysis and Review

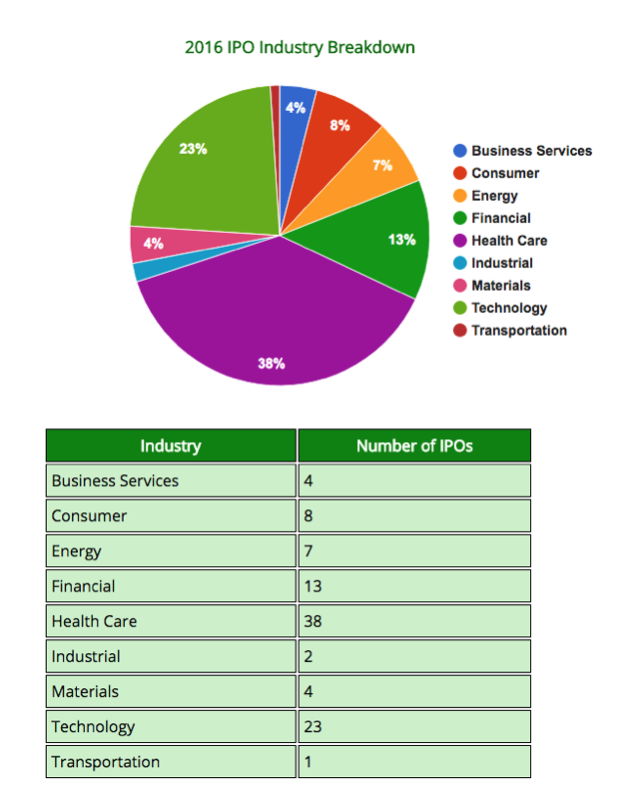

A steep decline in the number of deals coming to market continued in 2016. Last year’s depressed number of 153 IPOs was cut by 34.6% as just 100 deals priced this past year. This total does not include SPACs or unit IPOs. Proceeds from all offerings (including SPACs) 2016 totaled $18.8 billion–an $11.2bn decrease from the $30.0bn raised in 2015. There were just 38 healthcare IPO offering or 40 fewer healthcare offerings than 2015. Technology offerings reduced for a second straight year as 23 tech deals came to market versus 26 in 2015.

The strongest months for IPOs in 2016 were September and October, which brought 16 and 19 deals to market, respectively. It is our opinion that many companies were seeking to go public before a potentially uncertain political season, which did indeed produce a surprise result. A major factor in determining success of an IPO this year was the give-and-take of pricing. Deals generally fared well in those which the underwriter and company conceded pricing. Companies that seemed to push the limits of pricing in terms of both size and range, most notably ZTO Express (NYSE: ZTO), paid the price dearly. Overall, 70.2% of IPOs that came public in 2016 currently trade above their issuance price. First day pops averaged 11.4% with the average aftermarket return coming in at 11.0%.

HEALTHCARE

The Healthcare sector, with 38 IPOs, was 38% of the IPO market in 2016, down from 46% in 2015. The average return at first trade for healthcare deals was 9%. We believe the biotech sector will be less active in 2017. Looking at 2016 individual results, the best performing healthcare deal in its opening week was Syros Pharmaceuticals (Nasdaq: SYRS)—which priced $1.50 below its range and opened with $2.50 gain above the offering price. ‘SYRS’ traded as high as 72% above the offering price in its first week and, at the time of this writing, ‘SYRS’ was trading near its $12.50 offering price. The aftermarket MVP for the sector is AveXis (Nasdaq: AVXS), a gene-therapy biotech, which went public in February 2016. ‘AVXS’ severely underperformed out of the gate as the deal opened $1.98 below the $20.00 offering price. Since then the company has steadily gained in the aftermarket and is now trading near $50.00. One of the more disappointing biotech offerings of 2016 was Nant Health (Nasdaq: NH). ‘NH’ hit a first-week high of 72% above the offering price only to give back all of those gains and now trade roughly 25% below the offering price.

FINANCIAL SERVICES

There were 13 Financial Services offerings in 2015, 13% of the total offerings for the year, and a 40.9% drop from the 22 offerings in 2015. The average return on financial services deals at first trade was 6%. The best first-week performance and overall MVP from the financial services sector is Bats Global Markets which opened with a 20% pop and is now trading close to 75% higher than the offering price. It should be noted that 12 of the 13 financial deals opened with a positive gain making this sector one of the most stable and consistent performers in the IPO market.

TECH

23 technology IPOs were offered in 2016 with an average return of 27% at first trade—the highest among any sector. The best performing tech IPO at first-trade was Coupa Software Limited (Nasdaq: COUP), which opened 94% above its offering price. Acacia Communications (Nasdaq: ACIA) was one of the most volatile IPOs in 2016 as the deal opened $6.00 above its $23.00 offering price. ‘ACIA’ traded as high as $128.73 or 459% above the offering price. After a follow-on offering this deal has now settled down and is trading around $63.50 or 176% above its offering price. Nutanix (Nasdaq: NTNX), Twilio (Nasdaq: TWLO) and The Trade Desk (Nasdaq: TTD) also outperformed its peers by providing returns of 66%, 60% and 60% at first trade, respectively.

CONSUMER

The 8 Consumer IPOs represented 8% of the 2016 market and provided investors an 8% return above the offering price at first trade. The MVP of the sector was e.l.f. Beauty (Nasdaq: ELF), which opened $7 above its $17 pricing and is now trading roughly 72% above the offering price. The lone deal that opened below its offering price, Red Rock Resorts (Nasdaq: RRR), is now trading 18% above its offering price.

ENERGY

The depressed level of oil and gas prices continued to cap the number of energy deals coming to market. Seven energy companies went public in 2016 providing an average return of 4% at first trade. The MVP of this sector is Noble Midstream Partners (NYSE: NBLX), which is currently trading 63.8% above its offering price.

MATERIALS

There were four Materials IPOs in 2016 and those four provided an average gain of 9% at first trade. The MVP of the sector is SiteOne Landscape Supply (NYSE: SITE), which opened with a 22% pop at first trade and is now trading roughly 65% above the offering price. The most disappointing deal in this sector was Forterra (Nasdaq: FRTA), which opened 8% below the $18.00 offering price. ‘FRTA’ is now trading around the $22.00 mark or 22% higher above the offering price.

INDUSTRIALS

There were two Industrials IPOs in 2016 and Atkore International Group (NYSE: ATKR) was the best performing of the two. ‘ATKR’ opened $0.25 below the $16.00 offering price but is now trading near its all-time high at around $24.00 a share or 50% above the offering price.

TRANSPORTATION

There was one Transportation IPO in 2016, Camping World Holdings (NYSE: CWH), and that deal opened 8% higher with $1.75 gain above the $22.00 offering price. ‘CWH’ is now trading around $32.25 or 46.5% above the initial public offering price.

BUSINESS SERVICES

There was four Business Services offerings in 2016 and they collectively had an average return of 7% above the IPO price. The MVP of the sector was AquaVenture Holdings (NYSE: WAAS) as the deal is now trading at roughly $24.75 or 37.5% above the offering price. The sector included one of the worst performing IPOs in 2016, ZTO Express (NYSE:ZTO), which will be outlined in the next section.

LARGE OFFERINGS

Four offerings raised over $1 billion as compared to three in 2015. The largest deal in 2016, ZTO Express (NYSE: ZTO), was also one of the worst performers of the entire year. The deal was up-sized and priced above range only to open $1.00 below its $19.50 offering price. Since debuting, ‘ZTO’ has sold off tremendously and is currently trading more than 33% below its offering price. The other three deals that raised more than $1bn (Athene Holding, MGM Growth Properties and US Foods Holding) are each trading more than 10% above their respective offering price. Many possible large offerings could be on deck for 2017 as the current consensus indicates Uber, Airbnb, Snap and Pinterest are possible.

WORSE PERFORMING US IPOs

The ten worst performing US IPOs were comprised of 9 Health Care and ZTO Express (NYSE: ZTO). The three lowest performing IPOs were PhaseRx (Nasdaq: PZRX), OncoBiologics (Nasdasq: ONS) and Kadmon Holdings (Nasdaq: KDMN), which are down 71%, 58% and 57%, respectively.

PRIVATE EQUITY AND VENTURE CAPITAL IPOs

Of the 2016 IPOs, 30 were private equity and raised $8.8 billion. 25 of the 30 PE backed IPOs finished above their respective offering price. Some of the notable PE backed deals included e.l.f Beauty and Bats Global Markets which both performed well. There were 42 VC backed deals in 2016 and among that total 20 were healthcare and 15 were technology deals. The average return for VC backed healthcare deals was 32% above the offering price while tech deals returned 48%.

PIPELINE AND PROJECTIONS

Currently, the IPO pipeline consists of 71 companies. It is our opinion that 2017 may be a good to very good year for technology IPOs as many large and notable companies are waiting on the right time to go public. The key going forward will be to get pricing right. We believe the underwriters and companies will need to work together to ensure an aftermarket appetite as all parties’ involved need to remember than an IPO is not the end game. Taking a page out of the Acacia Communications (Nasdaq: ACIA) playbook, some of the great tech companies have made a far greater percentage of their returns after going public. Some of the high profile names that may go public include Snap, Palantir, Pinterest, DropBox, Spotify and Airbnb.