The first IPO of 2017 will be Keane Group (NYSE:FRAC) and it will, in all likelihood, be the solo deal for the week of January 16th. We examined this first IPO in a Tuesday post and took a look at recent IPOs in the energy sector as well as addressed other factors to account for when digesting the ‘FRAC’ IPO in a post on Wednesday.

Since, Keane Group is on the schedule…the next question in the IPO market is, who’s next?

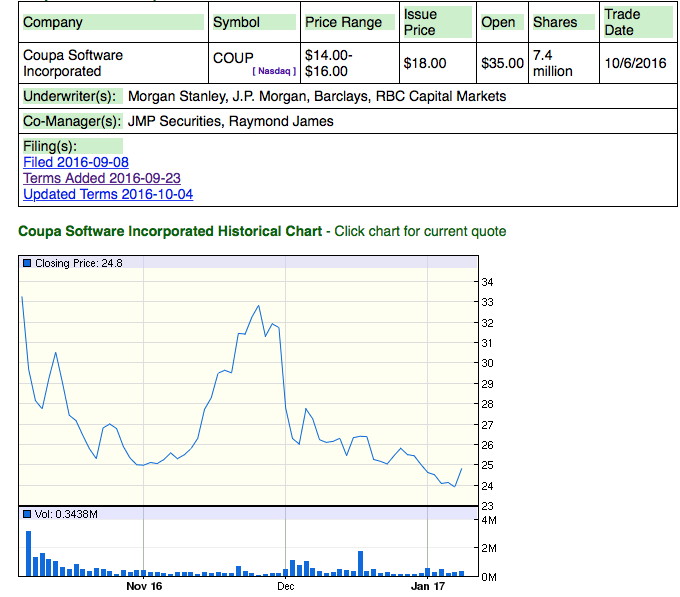

Sources indicate that AppDynamics (Nasdaq: APPD) may be one of the next to update terms marking the first high-profile (so to speak) technology IPO to go public since Coupa Software (Nasdaq: COUP) had its offering on October 6. $COUP opened 94.4% above its offering price and has been extremely volatile in its first three months of trading.

We created a video to better explain our services and how we can be a great value to those who are active in the syndicate market. Feel free to take a look and reach out to us if you have any questions.

What is @IPOBoutique and how can it help make and save you money in the #IPO and syndicate market in 2017? pic.twitter.com/kmBlFOEOtl

— IPO Boutique (@IPOBoutique) January 11, 2017

Other articles of note for this morning, Fierce Biotech wrote a piece pointing out the increase in insider buying of healthcare IPOs. The story also discusses the impact of a Donald Trump presidency on M&A.

Earlier this week, Ariad Pharmaceuticals (Nasdaq: ARIA) was purchased by Takeda for $5.2bn. That was quite the headline-maker right before the JPM Healthcare Conference which is currently ongoing. Healthcare has been one of the strongest sectors to start 2017 as the $IBB is up 7.9% year-to-date.

What was the best healthcare IPO in 2016?

We track our success rate on a first trade and first-week basis and Novan Health (Nasdaq: NOVN) outperformed the calendar year’s healthcare deals as it returned IPO investors 102% in its first few days of trading. The Piper Jaffray underwritten deal priced at the low-end of its range and is now trading 132% above the offering price.