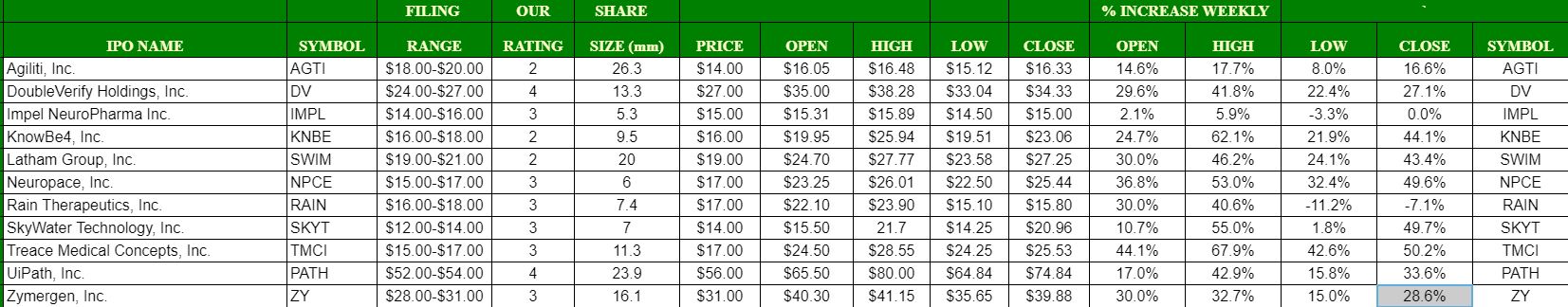

Eleven came to market in another robust week for new issues. Ten Of the eleven offerings opened 10% or more above their issue price and many saw nice “follow-through” action.

DoubleVerify Holdings Inc (DV) priced a full-size deal, 13.3mm shares, at the high-end of the range, $27.00, and opened at $35.00 for a gain of 29.6% at first trade.

UiPath Inc (PATH) priced 23.9mm shares at $56.00 ($2 Above the Upwardly Revised Range) and will opened at $65.50 for a gain of 17.0% at first trade. PATH traded as high as $80.00 in its opening week.

Security awareness platform, KnowBe4 Inc (KNBE) priced 9.5mm shares (downsized from 11.8mm) at $16.00 (low-end of the range) and opened at $19.95 for a gain of 24.7% at first trade. KNBE traded as high as 62.1% above the issue price at its peak.

The IPO that traded the best this week was chip-maker SkyWater Technologies Inc. (SKYT) which priced 7.0mm shares (upsized from 5.8mm) at $14.00 (high-end of the range) and opened at $15.50 for a gain of 10.7% at first trade. The stock closed Friday’s session at $20.96 or 49.7% above the $14.00 issue price.

Biotech and healthcare offerings were, once again, particularly strong.

Treace Medical Concepts Inc (TMCI) priced 11.25mm shares (upsized from 9.375mm shares) at the high-end of the range, $17.00, and opened at $24.50 for a gain of 44.1% at first trade.

NeuroPace Inc (NPCE) officially priced 6.0mm shares (upsized from 5.3mm) at the high-end of the range, $17.00 and opened at $23.25 for a gain of 36.8% at first trade.

Rain Therapeutics Inc (RAIN) priced a full-size deal, 7.35mm shares, at the midpoint of the range, $17.00, and opened at $22.10 for a gain of 30% at first trade. That opening print did not stick as RAIN closed the week at $15.80 or -7.1% versus issue.

Impel NeuroPharma Inc (IMPL) priced a full-size deal, 5.3mm shares, at the midpoint of the range, $15.00, and opened at $15.31 for a gain of 2.1% at first trade. IMPL closed the week flat.

Agiliti Inc (AGTI) priced a full-size deal, 26.3mm shares, at $14.00 ($4 below range) and opened at $16.05 for a gain of 14.6% at first trade.

Latham Group Inc (SWIM) priced a full-size deal, 20.0mm shares, at the low-end of the range, $19.00, and opened at $24.70 for a gain of 30.0% at first trade.

Zymergen Inc (ZY) priced an upsized offering of 16.1mm shares (increased from 13.6mm) at $31.00 (high-end of the range) and opened 30% higher with an opening print of $40.30.

Looking ahead to this week, there are currently five IPOs on the schedule.

Wednesday (4/28) Debut

- Aveanna Healthcare Holdings Inc. (AVAH) — They are a leading, diversified home care platform focused on providing care to medically complex, high-cost patient populations. The company is seeking a market cap of $2.9b-$3.25b based on the $16-$18 range.

- FTC Solar, Inc (FTCI) –– They are a global provider of advanced solar tracker systems, supported by proprietary software and value-added engineering services. The company is seeking a market cap of $1.5b-$1.65b based on the $18-$20 range.

Thursday (4/29) Debut

- Endeavor Group Holdings Inc (EDR) — Endeavor is a premium intellectual property, content, events, and experiences company. The company is seeking a market cap of $10.0b-$10.4b based on the $23-$24 range on a fully-converted diluted shares basis.

- The Fortegra Group, Inc (FRF) — They are an established, growing and consistently profitable specialty insurer. The company is seeking a market cap of $879m-$1.0b based on the $15-$17 range.

Friday (4/30) Debut

- Privia Health Group, Inc. (PRVA) —Privia Health is a technology-driven, national physician-enablement company that collaborates with medical groups, health plans, and health systems to optimize physician practices, improve patient experiences, and reward doctors for delivering high-value care in both in-person and virtual care settings (the “Privia Platform”). The company is seeking a market cap of $1.8b-$2.0b based on the $17-$19 range.

Indicating for IPOs or Secondary offerings? Place IPO Boutique on your team.

https://www.ipoboutique.com/blog/register/