Company: SendGrid, Inc.

Symbol: SEND

Description: They are a leading digital communication platform, enabling businesses to engage with their customers via email reliably, effectively and at scale.

Shares: 7.7 million

Price Range: $13.50-$15.50

Trade Date: 11/15

Underwriter(s): Morgan Stanley, J.P. Morgan

Co-Manager(s): William Blair, KeyBanc Capital Markets, Piper Jaffray, Stifel

Filed 11-2-17

Business: Their cloud-based platform allows for frictionless adoption and immediate value creation for businesses, providing their developers and marketers with the tools to seamlessly and effectively reach their customers using email. Since their inception we have processed more than one trillion emails.

They offer customers three services: their Email API; Marketing Campaigns; and Expert Services. Theiur Email API service allows developers to use their API in their preferred development framework to leverage the platform to add email functionality to their applications within minutes. This service enables businesses to send thousands or billions of emails, all with the same high level of service and reliability, and incorporates proprietary technology and domain expertise to significantly improve deliverability rates.

Their Marketing Campaigns service allows marketers to upload and manage customer contact lists, create and test email templates, and then execute and analyze multi-faceted email campaigns that engage customers and drive growth.

Their Expert Services help businesses further optimize their email delivery. With the SENDGRID platform, businesses can achieve industry leading email deliverability that translates into higher brand engagement with their customers.

CUSTOMERS: Businesses of all sizes and across industries depend on our digital communication platform. As of September 30, 2017, they had over 58,000 customers globally, an increase of 36% year over year. They believe a relatively small number of businesses have more than one unique paying account with SENDGRID, and they count each of these accounts as a separate customer.

Insider Buying: Certain of their existing stockholders associated with Bessemer Venture Partners, which is an affiliate of a member of their board of directors, have indicated an interest in purchasing shares of common stock with an aggregate price of up to $10.0 million in this offering.

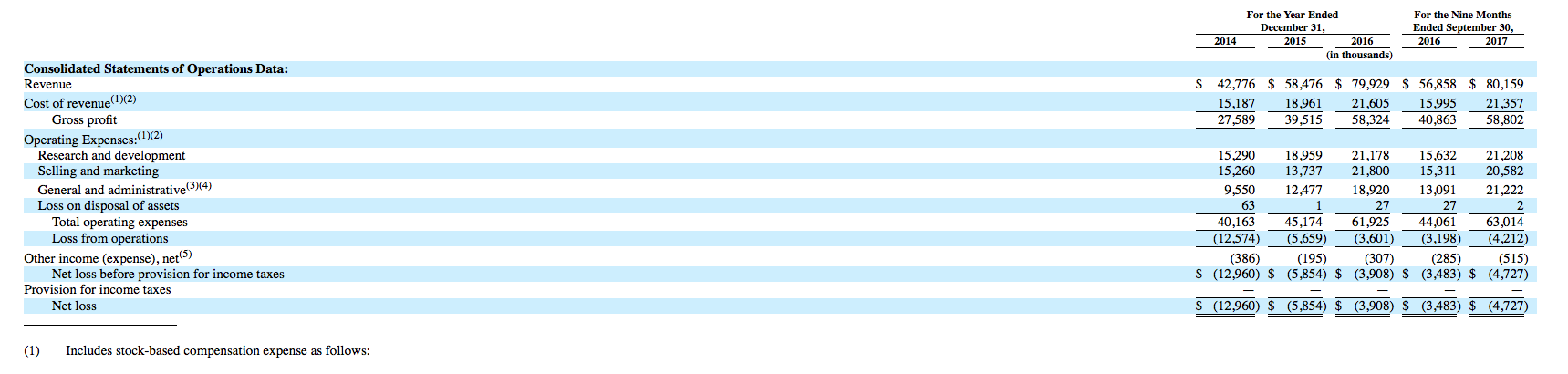

Financials: For 2014, 2015, 2016 and the nine months ended September 30, 2017; their total revenue was $42.8 million, $58.5 million, $79.9 million, and $80.2 million; their net loss was $13.0 million, $5.9 million, $3.9 million, and $4.7 million; their adjusted net income (loss) was $(12.2) million, $(4.5) million, $(1.4) million, and $1.2 million; their net cash flows from operating activities were $(9.6) million, $1.2 million, $9.7 million, and $10.1 million; and their free cash flow was $(13.6) million, $(4.0) million, $(2.5) million, and $0.2 million, respectively.

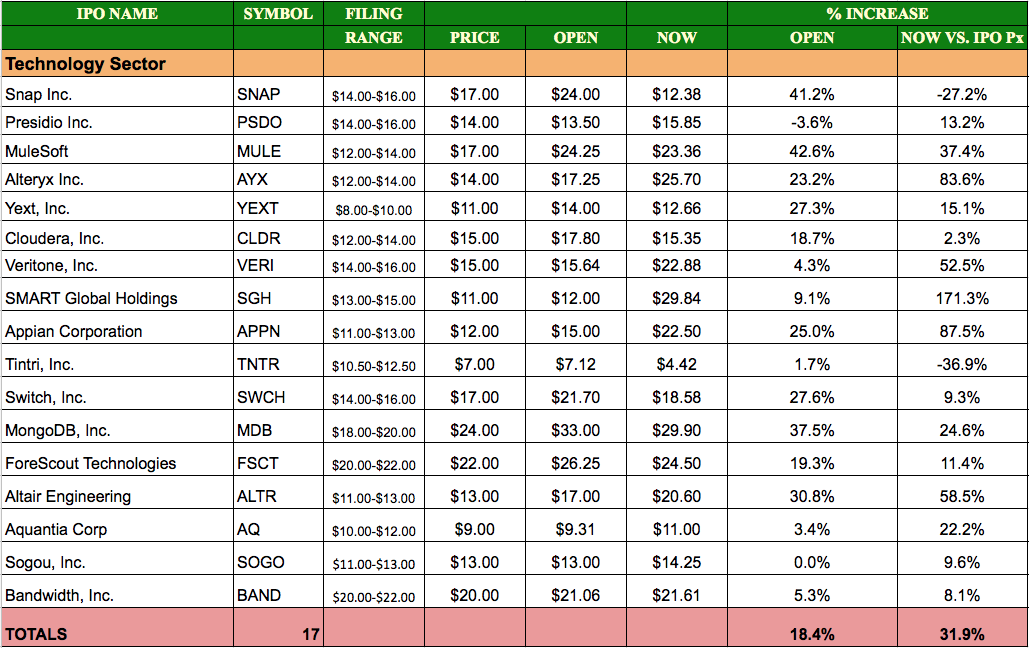

Tech IPOs in 2017 – How the sector has performed as of 11.10.17 intraday

Book-Building Status: The way the book comes together during the week of the roadshow is the bkost critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.