Company: Arsanis, Inc.

Symbol: ASNS

Description: They are a clinical-stage biopharmaceutical company focused on applying monoclonal antibody immunotherapies to address serious infectious diseases.

Shares: 3.125 million

Price Range: $15.00-$17.00

Trade Date: 11/16

Underwriter(s): Citigroup, Cowen, Piper Jaffray

Terms Added: 11-6-17

UPDATE 11/15: The terms of the offering have changed. The underwriter is now offering 4.0mm shares at $10-$10.

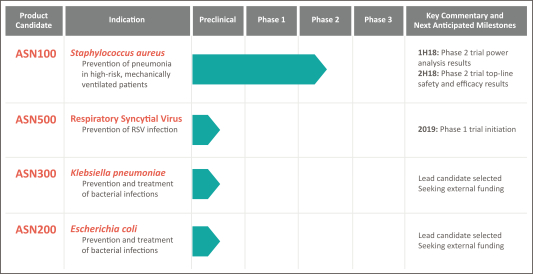

Business: Their lead product candidate, ASN100, is a first-in-class mAb therapeutic in Phase 2 clinical development for the prevention of Staphylococcus aureus, or S. aureus, pneumonia in high-risk, mechanically ventilated patients, a potentially life-threatening and costly infection for which there are no approved preventive therapies. ASN100 is a fully human mAb product candidate that they developed specifically to neutralize the six cytotoxins critical to S. aureus pneumonia pathogenesis, a scientific advancement that has not previously been achieved. Given its unique mechanism of action, they believe that ASN100 could improve the standard of care for mechanically ventilated patients who are heavily colonized with S. aureus and are therefore at high risk of developing life-threatening pneumonia. In addition to ASN100, their preclinical pipeline is comprised of mAbs targeting multiple serious bacterial and viral pathogens, including respiratory syncytial virus, or RSV.

Insider Buying: Certain of their existing shareholders, including certain of their directors and affiliates of their directors, and their affiliated entities have indicated an interest in purchasing an aggregate of up to approximately $20.0 million of their common shares in this offering at the initial public offering price per share.

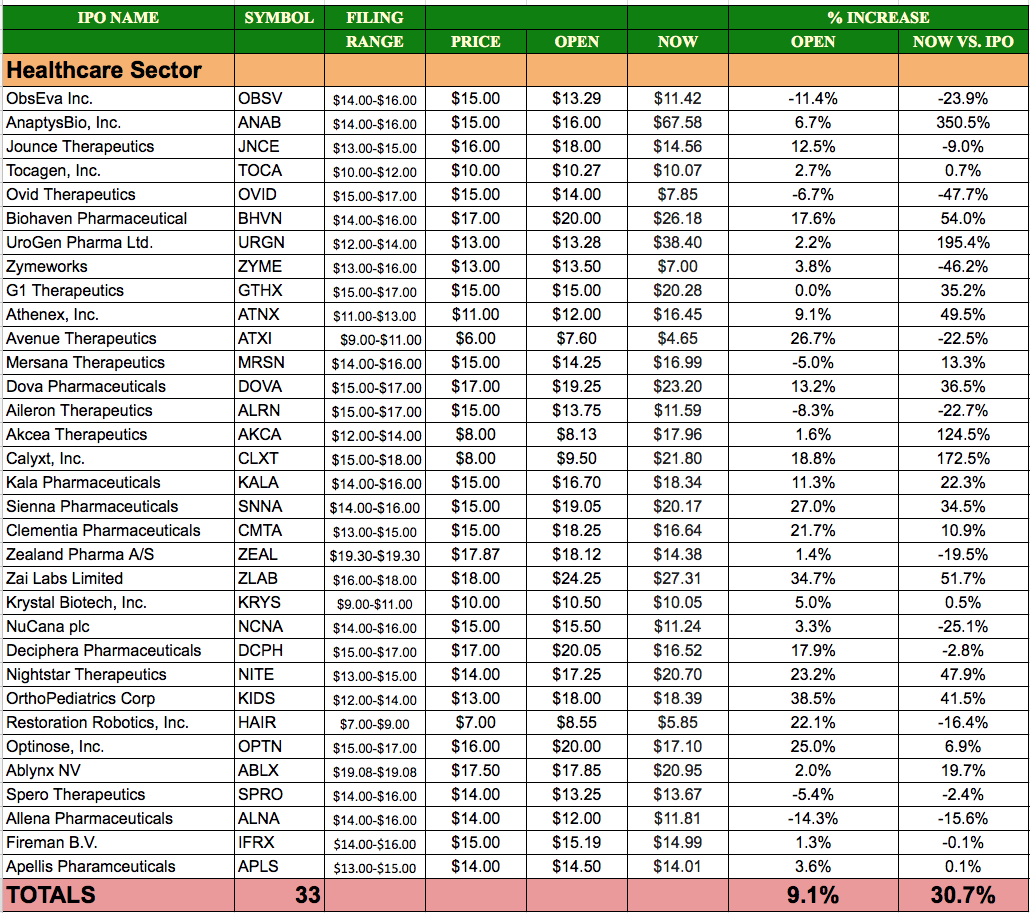

Healthcare IPOs in 2017 – How the sector has performed as of 11.10.17 intraday

Book-Building Status: The way the book comes together during the week of the roadshow is the bkost critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.