HIGHLIGHTS

- Current IPO pipeline of 53 is concerning

- New SEC confidential filing law benefits companies

- Increasingly difficult to project the IPO schedule going forward

If your pulse is on the IPO pipeline, you may have wondered if it has flatlined.

Or at the very least, you would think it’s on life support.

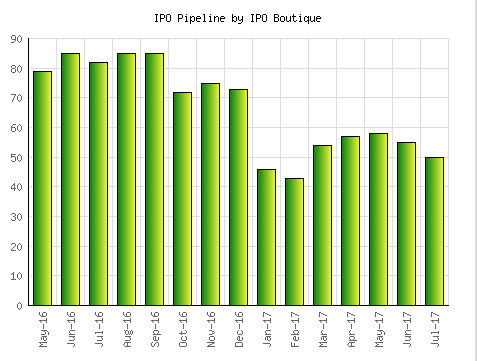

The number of companies that have filed official paperwork with the SEC to go public is concerning to many. Here is a rolling twelve month chart of the number of IPOs in the pipeline each month. IPO Boutique cleaned up the list in December 2016 by deleting IPO filings that were inactive by more than 24 months, and thus this accounts as to why there is a significant drop in January.

What makes the “lack of pipeline” even more alarming is that the projections in January called for 200 IPOs. We are sitting at the nine month mark without even cracking 100.

To make matters worse, naysayers are pointing to a pair of well-known companies with dismal performances since their IPOs earlier this year (SNAP, APRN) as the “warning sign” for companies to go public.

The bleak outlook, however, can be viewed through rose-colored glasses thanks to a newer law gives the public less transparency yet more hope.

The Securities and Exchange Commission (SEC) passed a law that took effect on July 10th that allows all companies to confidentially submit registration documents for shares that are being sold in initial public offerings or secondary offerings.

The benefit for the company is that it allows companies to keep details about offered shares, future plans, competitors, risks, factors and financial statements under wraps. The new rules now allow companies to stay under the radar (formally) until 15 days before they go on road shows. The thought process is believed that if a smaller company elects to cancel an IPO because of a sudden downturn in the overall market, it would not be perceived as a negative or “damaged goods”.

A company that comes to mind as having a negative sentiment in IPO circles because of showing their hand to go public (but never following through) would be grocery chain Albertson’s and or Univision.

The new rules inherently mean that the pipeline could be much more robust than what meets the eye. The companies that have officially filed in the last two weeks include Best, Inc., Zai Labs Limited, Quintana Energy Services and BJ Services. Theoretically, they could begin a roadshow post Labor day if they choose.

What’s the bottom line? The official pipeline for IPOs for the final one-third of 2017 is not as easy as black and white. We do know that unicorns (valuations greater than $1bn with large losses) have been waiting in the wings. We have heard rumors of confidential IPO filings from the likes of Spotify, Roku and StitchFix.

The transparency is frustrating for those looking for an accurate projection for the IPO market but the gray area also gives optimists hope about the future of this niche sector.

To subscribe to IPO Boutique’s premium service: click here.